How Do Construction Cost Rises Impact the Property Market? - May 2022

May 23, 2022 / Written by Rich Harvey

By Guest Blogger, Pete Wargent,

Next Level Wealth

Supply shock!

With massive supply chain interruptions around the world, overlapping supply shocks have seen construction prices soaring in Australia.

Reinforcing steel prices are up nearly 50 per cent, and the same is true for other steel products.

Timber prices have jumped 40 per cent, while plywood and board prices are up 30 per cent. And so the list goes on.

These are huge moves which will have significant impacts on the construction sector.

I recently discussed this dynamic with some developers at an event in Queensland.

Their view was that supply chains may well right themselves in time, but typically prices tend to be sticky and construction costs are unlikely to come back down by much, if at all.

If they prove to be correct, this suggests further developer insolvencies ahead - and an undersupply of dwellings - with the cost of building a new home gapping irreversibly higher.

Construction sector: under pressure

Recent producer price figures showed that the input construction costs for houses were up by more than 15 per cent over the year, driven by sharp increases in the price of timber and other metals.

Output costs across all construction sectors also increased at a double-digit pace for the first time since the data series began in 1996.

Although demand for residential property remains high, therefore, the construction industry is going through a tough time.

Contrary to what people might think, this has been a very challenging period for developers in Australia, with the price of materials and labour rising sharply.

Recently we have seen Probuild head into administration, while Condev and Privium have also stumbled into liquidation, leaving many live projects unfinished and contractors out of work.

In Perth, New Sensation Homes and Home Innovation builders are among the latest casualties over recent weeks, while a range of other players around the country have gone under.

The construction sector is one of the most important industries in the country, with over 1.1 million employees directly engaged in the sector, so this is a key cornerstone of the Australian economy.

Construction costs have continued to increase in the early part of 2022, so there is little respite in prospect for a beleaguered sector, especially with the Reserve Bank also telegraphing an increase in the cost of financing.

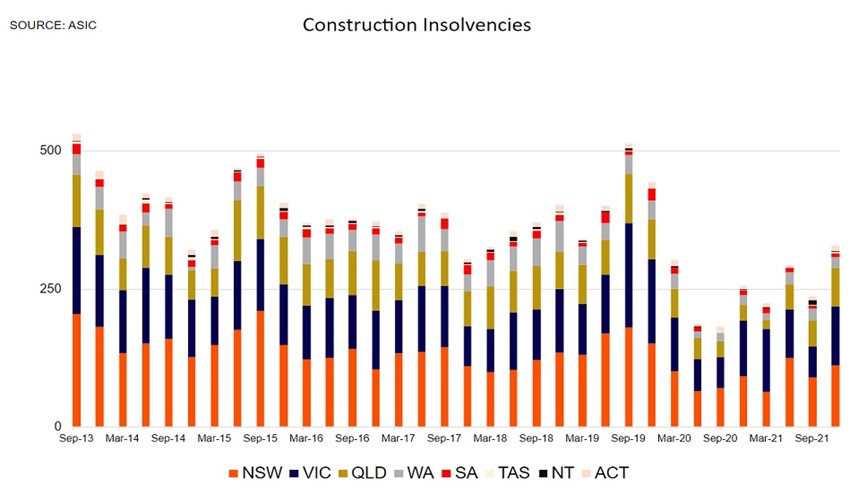

Further insolvencies will inevitably follow later in 2022. In reality, we’ve been through a couple of years when insolvencies in the construction sector have been artificially low, but now the impacts on supply of the global COVID restrictions are coming home to roost.

We expect to see construction insolvencies making up for lost ground and rising significantly over the year ahead.

Unfinished business

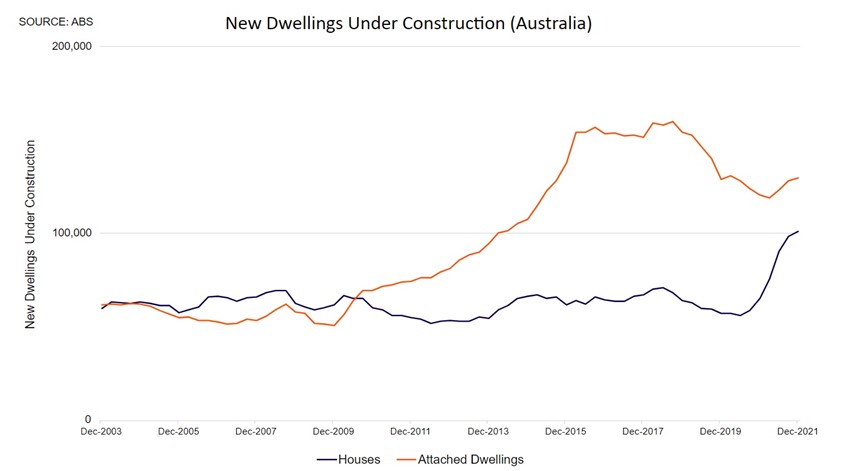

There is still a large pipeline of residential construction to be worked through.

Thanks to the government’s stimulus packages there were still more than 100,000 detached homes under construction all around the country at the end of 2021, so there is still a large pipeline of residential work due to being completed.

These homes are pre-committed and have done little to address the shortage of rental properties available on the market.

Unfortunately, given the domino effect of construction firms going to the wall, it seems increasingly likely that many of the higher-density projects will not be completed on a timely basis.

This comes at a time when rental vacancies are approaching all-time lows, and the opening of the international borders is facilitating more travel into the country.

The next formed government will face a major challenge in delivering enough new dwellings to meet the increasing demand for rental housing over the coming few years, and we can expect rents to rise significantly.

No Chinese bid this time

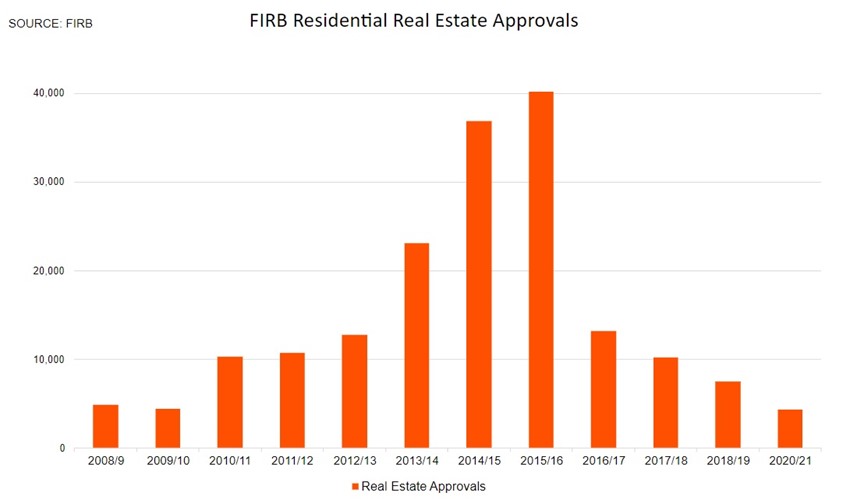

The absence of foreign buyers may also contribute to the significant undersupply of rental properties.

Over the past decade, new apartment projects have been funded by superannuation fund investors and non-resident investors, mainly from China.

Neither cohort is buying heavily anymore as credit has tightened, and as the HomeBuilder stimulus impact recedes we’re heading squarely for a shortage of rental properties in some cities and locations.

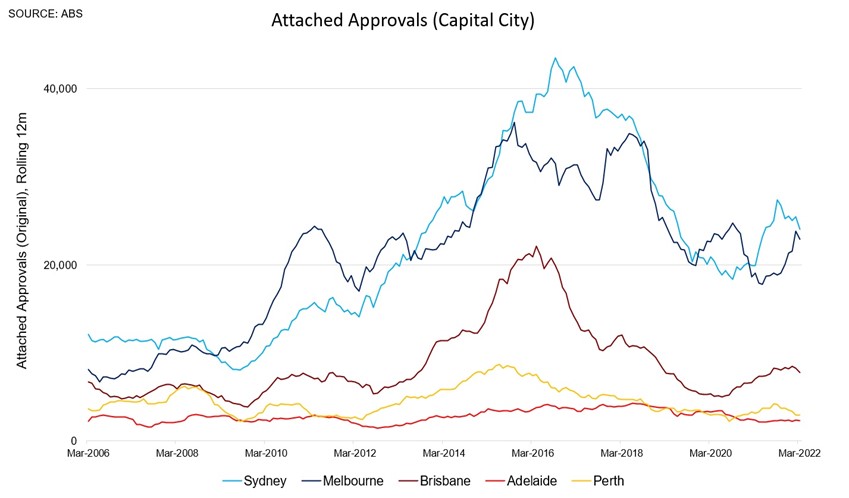

Building approvals: look out below

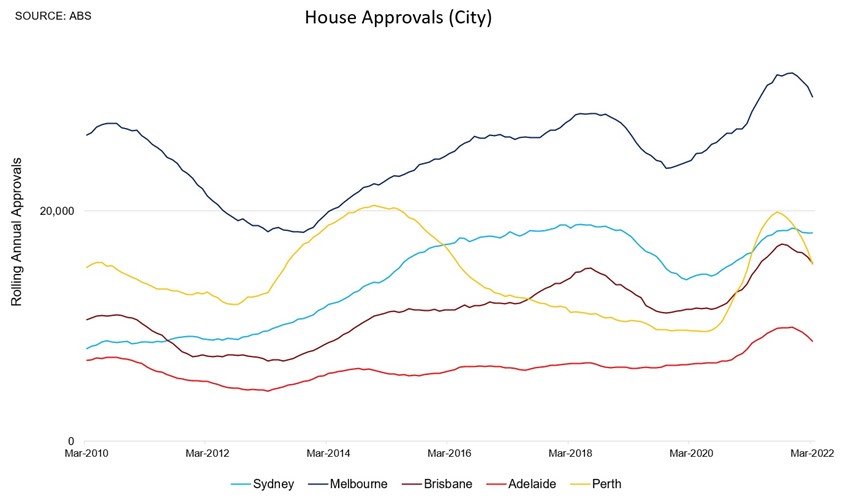

Building approvals are already falling and will continue to fall for the remainder of 2022.

Private sector house approvals continued to roll over in the March quarter, to be 32 per cent lower than a year earlier, as the stimulus fades and the twin rising costs of materials and construction bite.

Perth has seen the sharpest reversal, but the trend is down across the board.

Attached dwelling approvals in the private sector fell 30 per cent in March to be down 40 per cent from a year earlier, with Sydney posting some very low numbers in March, and Brisbane now rolling over.

This is in spite of surging arrivals, with around 100,000 more temporary arrivals forecast to arrive by July than had been expected only a few months ago.

Where to from here?

So, what next?

Here are three takeaway thoughts for you.

Firstly, building approvals will fall away now, at a time when the borders are reopening, with population growth expected to soar back towards 350,000 per annum by 2024.

High and rising construction costs will begin to hinder the new supply coming on to the market, with the cost of constructing a home up 20 per cent in 2021, and further increases already underway in 2022.

In my book that means we are heading for a rental crisis, and a chronic shortage of dwellings over the next few years.

Secondly, some twitchy homeowners have shelved plans to proceed with knock down and rebuild projects due to alarming cost blowouts and the ongoing shortage of tradies available, though many will still continue with renovation projects due to punitive stamp duty rates and the high transaction costs involved in moving house.

And thirdly, considerably higher dwelling replacements costs will underpin the housing market, even if rising mortgage rates do cause the Sydney and Melbourne markets to cool over the second half of 2022.

It’s the first time we’ve seen inflation like this for many years, and it’s causing some challenges in the world of construction, just as population growth in Australia begins to power back.

To have one of the friendly Propertybuyer Buyers' Agents to contact

you in regards to buying property :

call on 1300 655 615 today.

.svg)

.svg)

.svg)