How to pick the bottom of the market

February 8, 2019 / Written by Rich Harvey

By Rich Harvey, CEO & Founder propertybuyer

We all love certainty. We like to feel we are in control of our destiny. To some extent we are in control by the choices we make, but there are also many forces at play outside of our control.

The property market we are now experiencing after the boom has similar hallmarks to the GFC just over 11 years ago. We are going through the usual property cycle ups and downs - we just don’t enjoy the downside much – unless you are a savvy buyer. The trick to riding the property wave is learning how to read the signals that the market is at, or close to, the bottom and then gathering local knowledge and taking action.

So how do you pick the bottom of the market? I look for a number of signals and not all of these can be quantified into a single measure or sliding scale. I look for:

- Lower than average sales volumes

- Falling prices

- Low consumer sentiment

- Lots of media articles about property prices tumbling

- General fear of the market

- Low wages growth

- Low auction clearance rates

- Significantly lower numbers at open homes

- Maximum vendor discounting

- Days on market above long term average

- Potential interest rate cut is on the cards.

Corelogic have said the market in Sydney has already declined 12.3% and Melbourne 8.7%. Some economists are predicting a total fall of around 20% peak to trough.

On the other side of a market downturn is a stabilisation phase. This is the period where property prices are stagnant for a while before demand builds up and price begin to rise again. Markets do not turn around overnight – they are like a steam train that takes a while to build up momentum in a certain direction.

While there are plenty of stories of gloom in the property market my team and I are also seeing loads of opportunities and good long-term value buying. One of the best times to pounce on property is when the herd is walking the other way.

It takes gumption to go against the herd and buy when credit is tight, and others are saying the market could fall further. But remember that not all markets are the same. Local markets have local drivers and the majority of properties out there are not investment grade quality. You have to dig a little harder to find the best deal.

So what can you hang your hat on to have confidence the property market will rebound? In a nutshell it’s the economy. Migration numbers and natural births will continue to increase our population and the need to construct more dwellings. While there are some pockets of oversupply in the apartment market only – I predict we will see demand rise again slowly result in property deficits in the future.

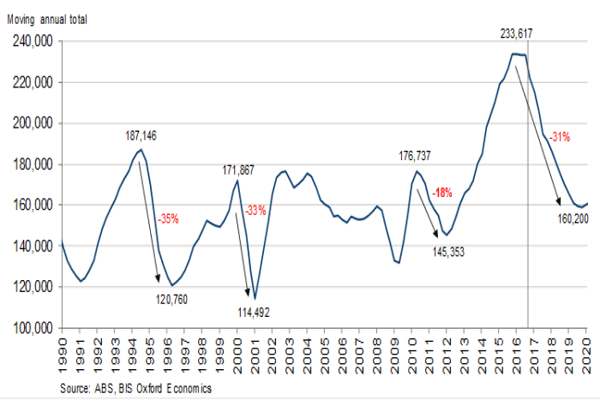

To satiate national property demand we typically need to build around 180,000 to 200,000 dwellings a year. When we dip below that range a deficit will build up over time, which eventually puts upward pressure on prices again. Note in the chart below we are now heading below that range.

At the beginning of the year, we see a little flurry of activity as vendors are now keen to sell at the start of the year. Some vendors are worried they will get less for their property if they sell now compared to 6 months ago – but they can’t wind back the clock. Vendors need to accept the current market conditions and realise that they are not going to get top dollar boom prices. But on the flip side when they go to buy, they will be able to secure their next property at a potentially lower price too.

With the State and Federal elections looming and banking Royal commission recommendations playing out over the year it will provide a fertile ground for media articles banging on about property market cracks.

My advice is if you are considering a property move this year, it is an ideal time to upgrade and secure a property at a cheaper long-term price. And for investors it’s ideal to find properties with upside potential and more negotiable vendors but be careful not to overpay. Get independent advice from our friendly team before taking the leap.

Send us your property brief , call us on 1300 655 615 or click here:

.svg)

.svg)

.svg)