Market Correction - Window of Opportunity for Buyers? - June Market Update

June 1, 2022 / Written by Rich Harvey

By Rich Harvey, CEO & Founder, propertybuyer

Written by: Rich Harvey, CEO & Founder

propertybuyer.com.au

Click here to watch Rich's Video of the June Market Update:

Many buyers are watching the media headlines - property prices falling / market correcting / interest rates rising / Ukraine war/ cost of living pressures….and more… Buyers are overwhelmed and just sitting on the sidelines watching and waiting. Some people are expecting a recession – others are less pessimistic and think we will have a soft landing with our resilient economy. Property sentiment can move very quickly up or down – even the threat of economic issues can drive buyer behaviour.

Bank economists are constantly watching the data and revising their property forecasts accordingly. One thing is very clear - we will see a succession of interest rate rises over the next 24 months, as we come off historically low interest rates. However, the RBA will be closely watching the impact on consumer and producer sentiment and slow down the rate of increases if it puts too much of a drag on the economy. Rising rates is a sign the engine room of the economy is firing up again, but the RBA also needs to tame the inflation beast.

Property has always been a high performing hedge against inflation. But you need to be a property Owner or Landlord in order to be in a hedging position!

My team of buyers’ agents have observed a significant pullback in demand at open inspections and auctions as compared to the peak of the market last year. One quality property in Terrigal sold for $2m under the hammer on Saturday afternoon with only 2 bidders and would have reached closer to $2.5m a few months back. We’ve seen some agents in the Eastern suburbs struggling to get traction on properties in the $5m to $8m+ range. On the Northern Beaches, we’ve seen a pull back of around 10% already on homes above $2.5m.

How long do property market corrections normally last?

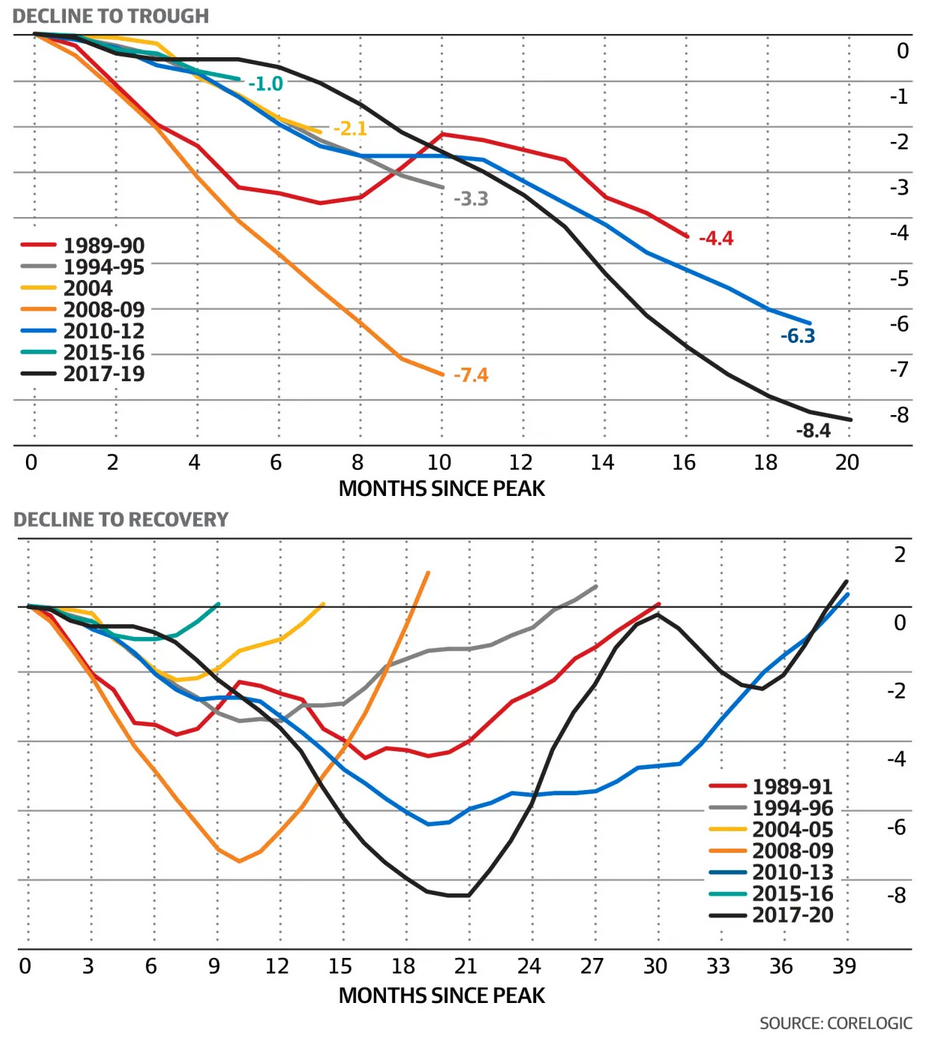

When we look back at the history of previous property peaks and troughs, we can see some clear trends. Over the past 40 plus years, the number of months it takes to find the bottom of the market (ie the “trough”) ranges from one month to 8.4 months (see chart below).

Furthermore, over the same 40+ year period, the recovery period for the property market ranges from nine months to three years for full correction.

As an economist in my previous life, I like to look for arbitrage opportunities. When the property market is declining, the volume of buyers is much lower, vendors are far more negotiable, and you have more time to look for good opportunities. Compare this scenario to last year, when the conditions were red hot, and you had 10 to 20 bidders at an auction, competition was crazy, and most buyers had FOMO.

I believe the next six months will provide the most prime buying opportunity that we have seen in the last five years.

What does all this mean for the ordinary buyer? Should you continue to sit on the sidelines and wait? Can you get an accurate read on when the market will bottom out?

How far will the property market correct?

As I've indicated in numerous articles and blogs before, trying to pick the bottom of the market is incredibly difficult. If you have the borrowing ability to get into the market today, then you would be relatively better off to move forward and buy now.

If prices have already dropped by 10% in the area that you are searching for, then it's not that difficult to negotiate a further 5% discount.

If we take some of the bank economists forecasted declines to the end of 2023 (Westpac 14%, ANZ 11%, NAB 10% and CBA 8%), then you can see that the market may not have that much further to fall. The trick is to buy just before everyone else thinks the market has turned a corner.

The market has turned quickly in Sydney to be more in favour of buyers while Melbourne is still seeing good demand with a more balanced market. Brisbane is still holding up well and competitive - and yet the heat has dissipated.

Factors that could spike demand again

With our unemployment rate currently at 3.9% and given the significant shortage of skilled workers, the government is ramping up the volume of skilled migrants giving increased permanent residence into Australia. The current cap is 160,000 but I believe the government will need to significantly increase the overall volume of migrants to get businesses fully back to work and at the highest production capacity. These migrants will typically rent for one to two years before they buy. So, this will put further pressure on the already stressed rental market and increase yields for landlords.

Financial data is showing that property investors have returned to the market and are actively looking. Property investors will be riding a strong wave of rent increases over the next few years which will offset interest rate rises.

Construction costs are likely to remain elevated, so this means that less properties will be constructed in the next 24 months. Buyers will be looking to buy established homes and try to avoid renovations so they can move in without delay thus raising the demand on newly renovated properties. Rising construction costs means the value of established property will continue to rise.

Take a long-term perspective

While it's not easy to go against the herd, some of the best buying opportunities that I have had in my own property career have been during periods of market downturns.

With households accumulating over $240 billion of savings during the pandemic - most consumers are in a healthy position and ahead on their mortgage repayments. If you have finance approval and are looking to buy a property, then a 10% to 15% decline in the property market is relatively small compared to the 30% plus increase we saw during the pandemic.

Property prices tend to be very resilient, and the correction phase is measured in a matter of months rather than years - so the window of opportunity to buy very well is usually not open for long.

Click here to get in touch with the Propertybuyer team:

or call 1300 655 615

.svg)

.svg)

.svg)