Property Market Direction - Falling, Stabilising or Rising? - April Market Update

April 1, 2023 / Written by Rich Harvey

By Rich Harvey, CEO & Founder, propertybuyer

Written by: Rich Harvey, CEO & Founder

propertybuyer.com.au

Click here to watch Rich's Video

|

If you've been reading property stories in the media over the past few months, you'll be forgiven if you are feeling confused about the future direction of the property market. There is such a plethora of data, opinions and commentators talking about different segments of the market. Being at the coalface of real estate everyday attending inspections, auctions and talking to buyers and agents, gives us an extremely unique insight into what is really happening in the hearts and minds of buyers and sellers. While the data may paint an historic picture of what has happened over the past month, we can see, hear and feel what is happening in real time. Right now, we are seeing a change in the winds. We are seeing a resurgence in demand from:

At the macro-economic level, it appears from the RBA rhetoric that interest rates may pause in April. Highly experienced forecaster Bill Evans, Chief economist at Westpac, is predicting a terminal cash rate of 3.85% with a pause in interest rates for April and one more rise at the May meeting. I have been saying for the past six months that the terminal cash rate will end up at 3.85%. If the cash rate tips over the 4% range, we are likely to see much greater financial pain on household budgets and the broader economy. Interest rates are not the only factor in town driving the property market. Surging migration and population growth are set to have the biggest impact this year and next. We will see a plethora of media articles about the rental crisis in the coming months. Expect to see vacancy rates staying very low in Sydney, Melbourne and Brisbane, and the number of applications per rental property dramatically exceeding supply.

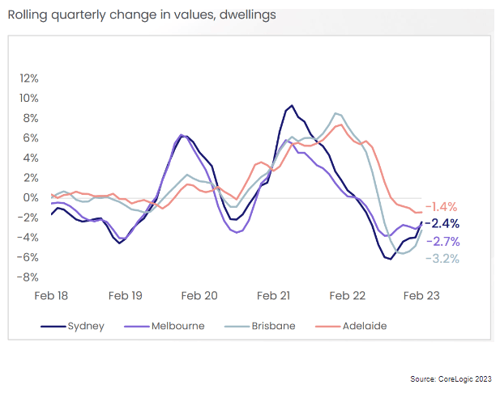

Where are we at now? We are seeing a mixed bag of results in housing prices. Prime blue-chip areas are seeing very resilient prices as there is a significant shortage of listings on the market in these areas. The latest data from CoreLogic shows that sales volumes are continuing to trend lower as buyer demand slows with national sales down 21.2% compared to the previous year. Total listing volumes are down 26.1% compared to their five-year average while days on market is now averaging 41 days compared to 20 days during the heady days of the Covid frenzy in 2021. The significant lack of stock is underpinning prices at the moment. Rents are surging over 10% pa, vacancy rates are very low (Sydney 1.3%, Melb 1.1%, Brisbane 0.8% and Adelaide 0.5%) and we are starting to see a leveling off and even uptick in price in some areas as evidenced by this chart below (Sydney had 0.2% rise in Feb).

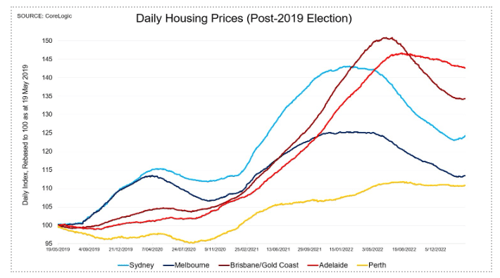

Here’s the rub - the bottom of the market cycle is typically a process, not an event. No one is going to ring a loud bell saying the bottom of the market will be on the 16th of April 2023. We will all look back and see a levelling out of the market as is broadly starting to show in the chart above – but this will occur at different times and locations. The market may bottom out in Sydney sooner than Melbourne for example. And Brisbane may see a sharper and quicker recovery because the vacancy rates are critically low. Prominent agents like John McGrath are calling the bottom of the market right now, as interest rates are peaking. There's no doubt we have some serious economic headwinds in front of us, namely the transition of most borrowers from fixed rate mortgages and that has been one of the reasons for the huge lag effect of previous interest rate rises. The bottom of the market in 2019 was unusual, in that there was an immediate V-shaped recovery, driven by an election result, a favourable outcome from the banking Royal Commission, and an interest rate cut…a trifecta of positive news within a matter of a few days. With over 15,000 suburbs spread across the cities and towns of Australia, and there are markets within markets, this time around the recovery will be slower, and not so easy to identify.

Looking back Headline figures such as the median price of a home in Melbourne or Sydney are typically reported in news articles, so the real truth of what's happening on the ground is not clear to the average buyer. Charted below are the median home price figures since the 2019 election. Despite some ups and downs along the way, median prices are overall higher than they were at that time, especially in Adelaide and Brisbane/Gold Coast, and to a lesser degree in Sydney, Melbourne, and Perth. Recently, prices have stopped falling and showing moderate increases in Sydney and some other markets.

Mexican standoff A large proportion of buyers and sellers are fence sitting, waiting for confirmation we’ve reached the bottom of the market before making a move. The problem with this approach is that it only takes one other bidder to be interested in a property and suddenly the whole negotiation dynamic is changed. What’s happening at auctions? Clearance rates are holding firm at circa 70% in Sydney and Melbourne and we are seeing moderate to strong bidding for high grade properties. For A-grade properties we have seen up to 20 registered bidders in Sydney and Melbourne, though not all that register are confident enough to make bids.

Recovery on the horizon The blue-chip inner and middle rings suburbs in major capital cities with lack of stock appear to have a stabilising market – and certain pockets of these areas are primed for price increases in the coming 12 months. How should you interpret the market? Firstly, remember the bottom of the market is a process not an event. Even when interest rates have peaked, there will still be some stressed borrowers seeing their fixed rate mortgages switching to much higher variable rates. The process from here is that the cash rate increases will pause, and then fixed rate loans will start to be cut as bond yields fall. Then as immigration ramps up to record highs, there will be reports of a chronic housing shortage. Rents will continue to rise sharply, which entices first homebuyers and investors back into the market (chasing yield). The media is likely to discuss a proper recovery during the second half of 2023 as median prices begin to rise, but procrastinating buyers will have missed the best of the opportunities by then. |

Click here to get in touch with the Propertybuyer team:

or call 1300 655 615

.svg)

.svg)

.svg)