Ripe for renovation: a recipe for opportunity…or a disaster in waiting? - January 2024

January 30, 2024 / Written by Pete Wargent

By Guest Blogger, Pete Wargent,

Next Level Wealth

Let’s take a look today at how renovations are impacting the property market landscape.

Over the past few years Australia has suffered with a tremendous shortage of construction materials, builders, and availability of workers in the trades.

There was a large surge in demand driven by the pandemic HomeBuilder stimulus, in tandem with some huge and ongoing public infrastructure spending.

With construction costs now having run so high are those "renovators delights" all they are cracked up to be?

Or are more buyers preferring to buy already-renovated homes?

Low stock and heated competition

We’ve definitely seen a lot of competition from buyers from ‘turnkey’ properties which are ready to move into, with no work to be done.

The flip side to this equation has been very low levels of housing stock on the market, which typically causes more homeowners to stay put and renovate their home, rather than upgrade.

This is particularly so the case these days with the very high transaction costs associated with upgrading, including stamp duty.

I have my own views on what’s been happening, based upon what I’ve seen first-hand in the market locally.

But I’m also aware that the plural of anecdote is not data.

So let’s take the subjectivity out of it, and take a look at what the figures are saying.

What does the data say?

I downloaded the most up-to-date information available from the Australian Bureau of Statistics to see what we can decipher.

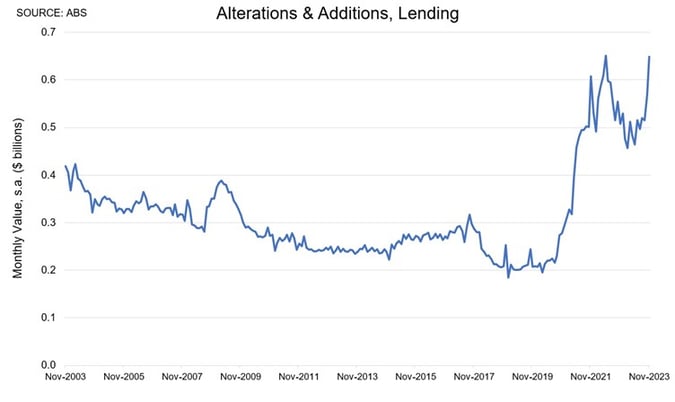

Firstly, we can see the dramatic impact of the government’s stimulus package from early 2020, with monthly renovation refinancing broadly tripling from around $200 million per month to around $600 million per month by late 2021.

That’s an extraordinary boom which shows just how powerful targeted fiscal stimulus can be!

Things certainly seemed to calm down a little in 2023 as mortgage rates increase, but interestingly then by November last year we were back at near-record highs.

Whether that’s just a blip or the resumption of the renovations boom is not yet entirely clear.

South-east Queensland boom

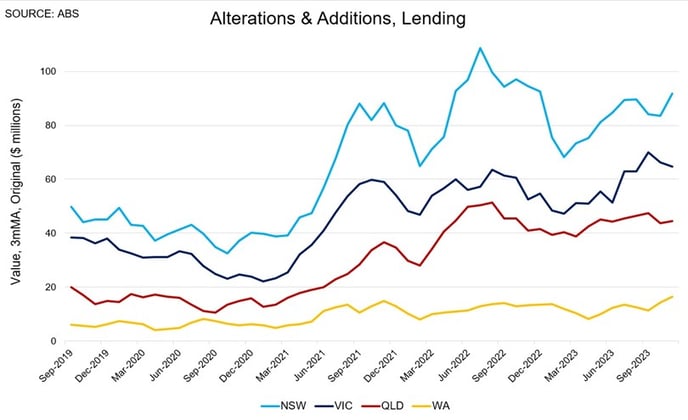

Smoothing the figures out a little, it seems that the recent increase has been driven by renovators in Sydney and New South Wales, where renovation financing is running at about double the pre-COVID levels.

But the largest percentage increase over the past few years has actually been seen in Queensland and Western Australia, where the value of renovation financing has more than tripled.

A few thoughts…

A few sundry observations.

Firstly, due to the chronic dwelling shortage, we’re seeing plenty of granny flats being built in south-east Queensland, which accounts for some of the elevated level of financing for major alterations and additions.

Secondly, probably at least a third of the increase in values has been due to rising costs and large budget overruns (i.e. as well as more people undertaking major renovations work).

And thirdly, the sceptic in me says that perhaps some of the more creative mortgage brokers may be using ‘renovations’ as an excuse to cash out for refinancing purposes, although admittedly I don’t have any hard evidence of that.

Still it is true that most buyers don’t want to renovate extensively, and this needs to be season in the broader context of monthly housing lending of around $30 billion.

Pros and cons

What are the pros and cons of buying a renovated vs unrenovated property for either a home or investment?

There are many potential pitfalls of renovations for the uninitiated, such as budget overruns, busy trades exploiting customers with heavy pricing, council approval delays, and much more besides.

And all of this is in an environment where mortgage rates are significantly higher than they were 18 months ago.

Thoughts on the cycle

The big question, then, is what impact has higher construction costs had on buyer behaviour?

Overall, it seems that stimulus and low stock levels have actually encouraged, rather than deterred buyers have undertaking renovations work, in spite of the higher costs involved.

But will this be a permanent change in buyer preferences?

Probably not.

Eventually as the cycle moves on, more stock will become available on the market again, and upgrading may once again become a valid choice for aspirational homeowners, without the need to undertake major renovations work.

In the meantime, while stock levels are so low, it’s well worth considering engaging an expert buyer’s agents to step you through the process, to pick out the gems, and avoid the pitfalls inherent in these exceptionally tight market conditions.

To have one of our friendly Buyers' Advocate's contact you, click here to:

call us on 1300 655 615 today.

.svg)

.svg)

.svg)