Struggling To Buy? Here's Why! - July Market Update

July 7, 2020 / Written by Rich Harvey

By Rich Harvey, CEO & Founder propertybuyer

Written by: Rich Harvey, CEO & Founder

propertybuyer.com.au

Click here to watch Rich's Video of the July Market Update:

There’s two key statistics to keep a close eye on in the property market – and they revolve around the value of property and the volume of transactions.

If you’re wondering why it’s hard to find a good property to buy at the moment, then you are not alone – lots of other buyers are struggling to find “the one”. It’s a lot like dating - but there’s a serious lack of good partners to ask out on the dance floor (or swipe left if you are a millennial).

Some of the reasons are external (ie you can’t control) while others are internal (you can control).

New Listing Volumes at Record Lows

The covid-19 economic fallout is still impacting consumer confidence. While we’ve seen a remarkable recovery in consumer confidence to levels about 5% off what they were pre-covid, many vendors and buyers are still in a “watch and wait” mode of thinking. Realestate.com.au has reported a record number of web visitors to their portal indicating that people are closely watching the market to see what is happening. I can also report that we have seen a 40% to 50% rise in web traffic to our own propertybuyer website which mirrors this trend.

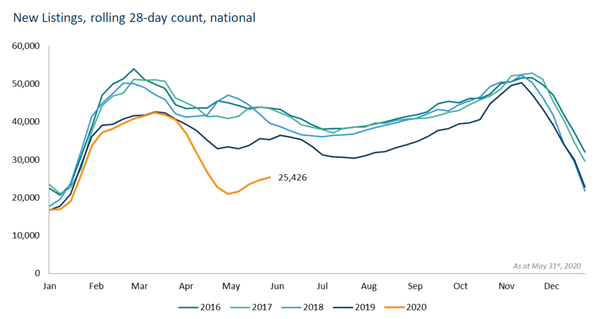

Corelogic report that new listings by vendors is trending up from the lowest point in April (when covid was at its peak). However, as shown by the chart below, the volume of new listings is still well down on previous years (down 40%+ compared to 2016/17). Compared to the same time last year, total listings are down 21% in Melbourne and 23% lower in Sydney. And even with the trend of new listings coming to market rising, the total listings rate has continued to trend lower meaning that the rate of absorption is very strong (ie good underlying buyer demand).

Source: CoreLogic July 2020

Financial Headwinds

Even though interest rates are at historic lows, borrowers are finding it much harder to get finance approval. Stricter lending criteria by banks and low wages growth has combined to put downward pressure on the borrowing limits of property buyers. I have seen several cases where a clients’ finance pre-approval has expired, and they then need to resubmit new financials and the lender comes back with a borrowing limit $100k lower than before. We are also seeing evidence of some lenders taking more than 15 days to process loan applications due to the volume of work and complications with covid. We work closely with quality finance brokers that assist our clients in finding the best loan and lender for their individual situation. Lending policies change weekly so it’s impossible to keep up unless you have a top broker managing the process for you.

The prospect of unemployment from a redundancy or company shut down is also a real threat for many people which makes many buyers stay on the sidelines.

Negative Media Headlines

Last week we saw some sensational headlines when CoreLogic released their monthly price update showing that prices had declined 0.7% in June – and the media made out that prices have “tumbled” or “crashed.”

I often hear people say that they are “doing their research” and then I ask them where they get their research and they say from the “media”. Well we all know there is perception and there is reality.

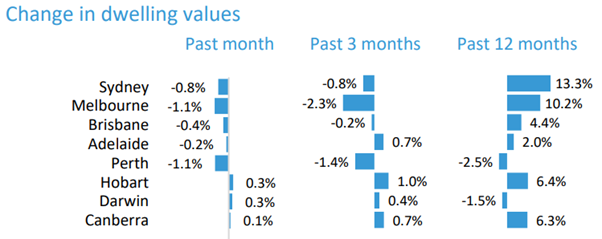

The perception is that the property market is weak and floundering and about to crash when Jobkeeper ends and this recession really bites. But the reality is that property prices have only dropped marginally from their peak and we have seen a very mild correction. June prices declined just -0.8% in Sydney and -1.1% in Melbourne, however both cities are still showing a 12-month positive gain of 13.3% and 10.2% over the entire year (see chart below).

The significant government stimulus package has protected the market from a major decline, along with banks offering loan repayment holidays, and extremely low interest rates. The scarcity of listings is also holding up property prices strongly.

The Reserve Bank believe that the Australian economy should emerge better than expected and is on course somewhere between best case scenario and central case scenario which means a softer recession and earlier return to economic growth.

Source: CoreLogic July 2020

Property Price Direction Next 6 to 12 Months

Buyers should take a much longer-term view of the market than the past three months and understand market forces will eventually play out despite the negative perceptions that pervade the economy. There are still real economic headwinds from the current recession but the underlying strength of property demand, the very strong stimulus support and the early than expected return to work will mean the property market resumes its cycle once again.

It is vital to note, the whole economy does not hinge on when Jobkeeper finishes. While there may be some more economic pain for specific sectors of the job market, the majority of workers will still be in full time employment and consumer confidence will rise once again to more normal levels. I think that there will be a surge in buyers coming out of the woodwork in September looking for property.

It is during these times of uncertainty that buyers have the best chance of buying slightly below long-term market value and getting a better deal. To get ahead of the buyer surge shake off those winter blues and buy before spring. Don’t feel like you must struggle to buy alone. Reach out to our friendly and professional team of buyers’ agents who can lend a helping hand.

If you would like to chat to my friendly team of buyers' agents about your property strategy in the year ahead please give us a call on 1300 655 615 or email us today to start a conversation. We’d love to help you on your property journey.

Or click below to:

and tell us what you are looking for.

.svg)

.svg)

.svg)