The Great Housing Undersupply - April 2023

April 18, 2023 / Written by Rich Harvey

By Guest Blogger, Pete Wargent,

Next Level Wealth

Record low rental vacancies

Rental vacancies in Australia’s capital cities slumped to the lowest level on record in March 2023, according to CoreLogic, at under 1 per cent across the combined capitals.

Rental vacancies are now trending higher in Canberra, Hobart, and Darwin, as well as many regional areas of the country, as the HomeBuilder stimulus supply now hits the market.

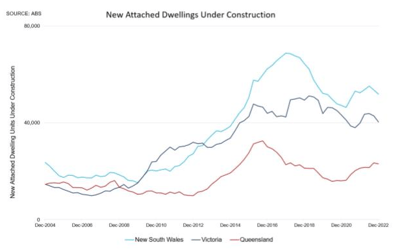

On the other hand, in the three largest capital cities there is a looming shortage of housing.

The National Housing Finance and Investment Corporation (NHFIC) recently published figures estimating that over the next four years we will have a housing deficit of at least 108,000 dwellings.

The drivers of the shortage

What is causing this national undersupply issue?

Treasury estimates that between this financial year and the next there will some 650,000 migrants heading to Australia.

We’re in the eye of the storm right now for record high population growth: international students, working holidaymakers, and permanent migrants are all flooding into Australia.

This is happening at a time when landlords have been discouraged for the past 7 or 8 years by policy settings, and lending conditions have also been tightened by regulators.

Is there anything that politicians at a state or federal level can do to quickly reverse this situation?

Not really in the short term.

We still have around 100,000 detached homes under construction, but higher-density dwellings normally take 2 to 3 years to come online, and foreign buyers have been taxed out of the market.

The key numbers

Let’s look at a few of the key numbers.

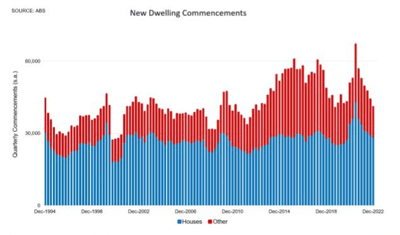

Dwelling starts have fallen to around decade lows now, at about 43,000 in the December 2022 quarter.

New home sales and financing for construction have slumped to around the lowest levels since the global financial crisis, and it’s often not viable for developers to build right now, given high construction and materials costs.

Dwelling completions have slowed too, but still the number of units under construction around the country is now in decline.

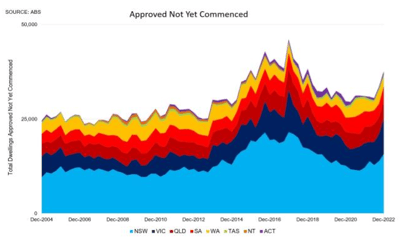

Another crucial point is that with many builders and developers working on fixed price contracts, we are seeing the highest number of developer insolvencies in a decade because of the soaring cost of materials and trades.

Unfortunately, therefore, many of the dwellings approved for construction will never be built.

In short, Australia is heading squarely for a chronic shortage of housing between now and around 2027, and rents are rocketing as a result.

…and the outlook

In the medium term, more supply will come on to the market from initiatives such as Build to Rent, by around 2026 or 2027.

In the short term, supply is not going to increase materially until housing prices do.

Unit prices probably need to rise by at least 25 per cent before developers can make the numbers work, unless the government produces some other initiative to kick-start the next cycle.

What does this looming undersupply mean for homebuyers and property investors?

In the immediate term, more renters will look to get onto the ladder as soon as practicable to avoid paying steepling rents.

In addition to scorching rents, property investors will likely see prices rise in the undersupplied market over the next few years, as is already evidenced by house price expectations.

Westpac saw its index for house price expectations exploded 43 per cent higher since November, and historically this has always been a leading indicator for prices.

To have one of the friendly Propertybuyer Buyers' Agents to contact

you in regards to buying property :

call on 1300 655 615 today.

.svg)

.svg)

.svg)