2024 Property Outlook - Seven Trends to Watch - January Market Update

January 1, 2024 / Written by Rich Harvey

By Rich Harvey, CEO & Founder, propertybuyer

Written by: Rich Harvey, CEO & Founder

propertybuyer.com.au

Click here to watch Rich's Video

Happy New Year and welcome to 2024! The property market in 2023 demonstrated strong resilience despite rapidly rising interest rates, the heavy weight of additional mortgage payments and rising cost of borrowing.

The lack of stock, low vacancy rates and an extraordinary rebound in migration levels contributed to strong price growth in 2023. What is the outlook for 2024 and how will households cope with the current financial strain? To kickstart my perspective on the year ahead, I’ve outlined seven major trends to watch closely as the year unfolds.

1. Population growth and migration will outstrip housing supply.

With over 500,000 people migrating to Australia, our population increased 2.2% according to the latest ABS data. While migrants don’t usually immediately buy a house, the flow on impacts to our rental market and other market segments means that we have a shortage of housing. The Federal Government has set the ambitious target of building 1.2 million homes over the next 5 years (ie 240,000 homes per annum), but this lofty target is very unlikely to be achieved because of the lack of coordinated policy planning with the state and local council approval processes, the higher costs of construction and continued labour shortages.

2. Interest rate cuts will re-ignite demand.

Financial markets are tipping that interest rates have peaked as inflation is now trending in the right direction. The US Fed Reserve has changed their stance on interest rates and is now forecasting cuts by mid-2024. In Australia, the slower decline of inflation may mean we have “high rates for longer” until inflation is well and truly headed below the 3% level (within the RBA target band of 2%-3%). This may mean we have to wait to Q3 or Q4 for interest rate cuts. But once we actually see interest rates cut by the RBA, watch demand for property re-accelerate! Consumer confidence has been sluggish for the past 12 months, but interest rates cuts deliver positive news for household budgets which feeds into stronger consumer sentiment and will likely spur passive real estate buyers into action.

3. Affordable locations will see massive demand.

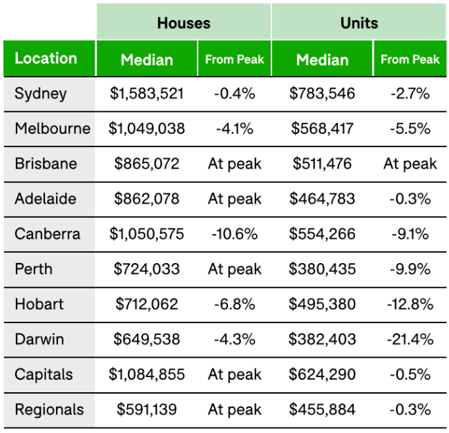

With the cost of owning a home becoming further out of reach for younger Australians, first time buyers will particularly be targeting the more affordable locations to get a foothold on the property ladder. Equally first-time property investors will be chasing locations to suit their borrowing capacity and focus on locations that have the greatest potential for capital growth and high rental yields. With the median house price in Sydney at over $1.5m and Melbourne over $1m, the chase to find more affordable suburbs is on.

Source: Domain 2023. End Of Year Report

4. Prestige property will remain resilient.Australia’s luxury property market will continue to surge in 2024, driven by both local buyers and expat and foreign buyers seeking the highest quality locations and property types their cash can afford. Chinese buyers are driven by water views, nice aspect, top schools and privacy and security. Local buyers want iconic views, waterfronts, expansive floorplans, top-quality finishes and more.

The majority of prestige buyers are buying with cash and are therefore not impacted by higher interest rates on a mortgage. The extremely limited supply of prestige property, the stable political and economic situation plus our excellent natural environment, put Australian real estate on the radar of many wealthy millionaires and billionaires.

5. Downsizers will dominate.

With so many baby boomers and generation X retiring and looking to downsize in the coming decade, the market for downsizers will be massive. The downsizers are seeking to cash in on the large equity gains of their homes and relocate to properties that require less maintenance, are situated nearer to amenities, cafes, beaches, parklands and have a sense of community with others their own age. Developers are seeking to capitalise on this trend and are now building spacious three or even four bedroom apartments with double garages and ample storage. The downsizers can also take advantage of the $300k top up to their super funds.

6. Rents will continue to rise (but stabilise).

As property prices continue to climb, more people will be pushed into the rental market. Vacancy rates all around the country have been extremely low and the rental market very competitive. With divorce rates still around 30% and demographic trends of later marriage, aging in place, and other lifestyle choices, we are seeing more single occupancy households. Record numbers of students returning to Australia to study has also put pressure on the rental market. Rents have surged around 10% this year and are likely to rise another 7% or 8% in 2024 due to lack of rental stock. However, renters will also be hitting their own limits of rental affordability, and we are likely to see rent rises flatten out toward the back end of 2024.

7. Savvy investors to capitalise on market conditions.

With borrowing capacity down more than 30%, property investors have found it harder to get into the market. Adverse state land taxes by Victoria (and previously QLD before they reversed the decision) have also deterred many potential investors. The majority of Australia’s rental stock is provided by mum and dad type investors simply saving for retirement. The savvy investor knows that “counter-cyclical” investing is one of the best ways to get ahead. There are likely to be opportunities to buy properties from financially motivated or stressed sellers in 2024 as the true impact of rate rises really bites home.

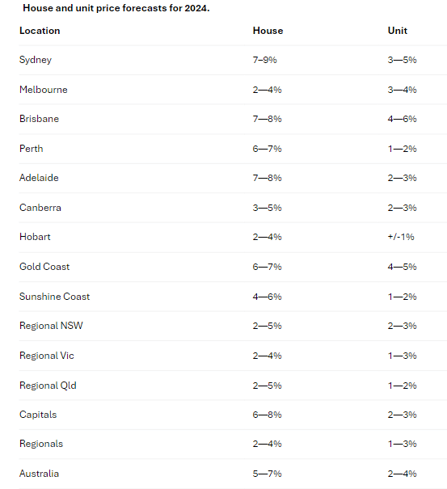

And finally, to finish off, what is the outlook for property prices this year? It's most likely that 2024 will see more subdued conditions and a much lower rate of growth and mixed results amongst each capital city. As indicated above and in many of my previous updates, the low housing supply situation will underpin price growth in most areas. Below are the price forecasts from Dr Nicola Powell, Domain Chief of Research and Economics.

Source: Domain, End-Of-Year Wrap and 2024 Outlook

I recommend you do not pick your next investment location on the basis of a one-year prediction. Take a longer-term perspective and use current data to understand the drivers of price growth in the particular suburbs you are considering.

Please reach out to my friendly team of buyers advocates if you’d like help in discussing your next property move. Until then, enjoy your summer holidays and stay safe.

.svg)

.svg)

.svg)