A Looming Unit Undersupply Is A Golden Opportunity - September 2022

September 12, 2022 / Written by Rich Harvey

By Rich Harvey, CEO & Founder, propertybuyer.com.au

For some years now, attached housing has been given a bad rap. A raft of adverse news has seen all sorts of people – from everyday mum and dad purchasers through to experienced property experts – declare units are off limits when it comes to savvy investment or homeownership.

But the world had changed dramatically over the past two years, so I’m ready to say out loud that conditions are ripe for buyers considering an apartment purchase.

Here are the reasons why a looming undersupply of attached housing is heralding an excellent opportunity for potential unit purchasers.

Lousy reputation

As mentioned, units have had very few good news days in the past decade.

Adverse reporting has included unsavoury moves by some developers who used sunset clauses to cancel off-the-plan unit contracts when property values began rising sharply. This allowed them to resell already contracted apartments for substantially more during the construction period.

Then there are those special clauses in off-the-plan contracts that allowed developers to adjust the square metreage of apartments during construction. What was already purchased could be altered during the build and there was nothing the purchaser could do about it.

Then there was the Opal Towers fiasco where structural defects saw a newly completed project vacated as cracks opened in the building’s foundations.

Perhaps the most widespread event however was the oversupply of units that accompanied the construction and development boom in our major population centres about seven years ago. As prices rose, so too did construction pipelines. Buyers were eager to be part of the market and rushed to purchase off-the-plan apartments. This stimulated even more development. Of course, this type of hot price run can’t last forever. Eventually prices softened and demand fell. The fallout was that a swathe of approved or half-built towers flooded the market and pushed all unit prices down.

All this bad news has hurt the reputation of apartments, but I think the tide has turned.

Why now is the time

Anyone with even a passing interest in property and the economy knows we’re in tough economic times at present.

Fallout from the post-pandemic downturn includes exploding construction costs and little to no available labour. This has had a direct impact on the supply of attached housing stock.

Because large scale projects take years from inception to completion, there are shovel-ready developments throughout our major cities where construction progress has ground to a halt. All sorts of part-built or advanced-planned ventures can’t proceed because the cost of completing them has become unviable.

This means a raft of attached housing that was supposed to hit the market has now been shelved.

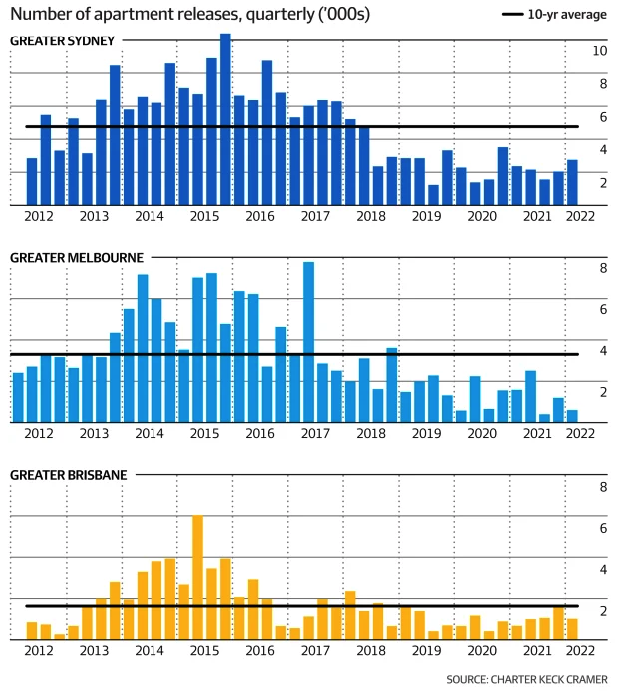

The irony is this has occurred at a time when much of the previous oversupply has been absorbed. Analysis by Charter Keck Cramer shows that apartment supply has already been trending lower across our three largest capital cities.

Supply is now trending below the 10-year average line in Sydney, Melbourne and Brisbane – and because of market conditions, it’s only going to get tighter.

Rising demand

The other side of the equation is always demand and that will be driving price rises higher in attached housing too.

One of the great challenges for Propertybuyer at present is housing affordability in Australia’s most desirable cities. Booming capital gains in housing from late 2020 to the start of 2022 have amplified the problem. Despite very recent value softening in many markets, units are still attracting buyers. The reason is that they offer a price-accessible entry into excellent locations.

And I believe this demand will continue to ramp up. Cost of living pressures, rising interest rates and challenges around gaining finance approval all come into play here. With a more limited budget, buyers will increasingly turn their attention away from houses and towards apartments.

Perhaps most compelling of all is the rental crisis and what it will do to our markets in the next couple of years. The demand for rental property isn’t softening anytime soon. Not only is our existing population crying out for more rentals, but a reopening of our borders will elevate the problem to a new level.

The federal government announced at the recent Jobs and Skills Summit that they are increasing the permanent Migration Program ceiling to 195,000 in 2022-23. That’s great… but where will these new Aussies live in this competitive rental market?

I see the level of demand rising which will compel more investors towards units to take advantage of even higher rents and lower vacancies.

And for those who don’t want to be tenants any longer, apartment ownership will be the most likely solution. This means more buyer demand for attached housing.

The key to successful apartment investment

There is one key piece to this puzzle however and that is asset selection.

Whether you’re an investor or a homeowner, choosing the right property is crucial. You need to select an apartment which will meet your needs now, while delivering the right fundamentals for long-term capital gains and rental return.

For example, you need to unearth an asset of high-quality construction with good noise abatement measures and safety at the forefront. The unit must be part of a functional body corporate with no special levies proposed. You want design that incorporates a good aspect, natural light, a balcony space, secure parking and desirable but not overly expensive common area features.

This is where a buyers’ advocate can help. We apply our skills and experience to identify and secure the right apartment for you. Our extensive network of contacts and advanced negotiation skills will work to your advantage.

There is certainly plenty of upside to be had in the apartment market right now, but the window of opportunity is closing. Make sure you have the right guidance on your side with a specialist buyers’ advocate.

To have one of our friendly Buyers' Advocate's contact you, click here to:

call us on 1300 655 615 today.

.svg)

.svg)

.svg)