Advice On Buying Property Near Water - March 2022

March 29, 2022 / Written by Rich Harvey

By Guest Blogger, Pete Wargent,

Next Level Wealth

Many Australians would dearly love to live near the beach or with a water view.

But, as we've seen in recent times, living near water can sometimes be too close for comfort when it comes to excessive rain and the resulting flooding.

Recently towns such as Lismore and Gympie have experienced the full force of nature, with catastrophic flooding in some cases.

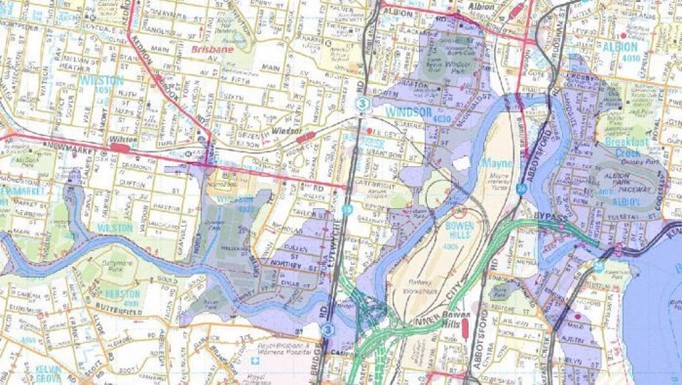

After a major flooding event in 2011, Brisbane has once again been impacted in early 2022, with an estimated 15,000 homes directly impacted at the time of writing.

The initial focus will be on personal safety and the clean-up, then repairs and maintenance, and then insurance claims.

Flood mapping and flood risk

To its credit, Brisbane City Council has put a good deal of time and effort over the past decade into provide free flood mapping resources, such as Floodwise reports and suburb flood maps.

This helps to give buyers some level of transparency as to areas which have flooded previously, and therefore may be at risk of doing so again.

Sometimes owner-occupiers are prepared to buy in flood risk zones, if they find a property which fits all of their other criteria, and if they really love the location.

For most investors, the opportunity to snare a potential bargain is usually offset by the risk of stunted capital growth (as future buyers may see potential flooding risk), and because the annual insurance premium when buying in a flood zone may be excessively high.

For an interstate investor in particular, there is less sleep at night factor if you own a property which you fear may be flooded at some point in the future.

Buying near a major river or waterway

Water – and particularly water views – tend to be a strong drawcard in Australian property.

Often properties with water views can appear to march to their own drum, performing well even when the wider market is lacklustre.

A water view which can’t be built out is a genuine point of scarcity and desirability which tends to be reflected in long-term outperformance in Australia.

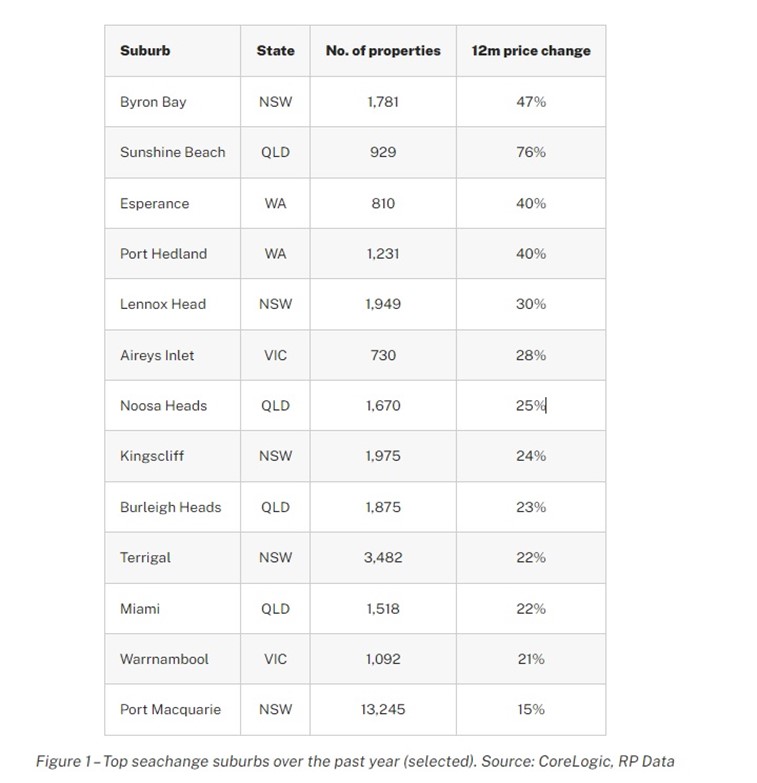

We recently ran a market research report to decipher whether sea-change or treechange markets had outperformed in 2021 through the COVID-19 pandemic and the associated ‘race for space’.

Take a look at the top performing coastal markets.

Impressive results, to say the least.

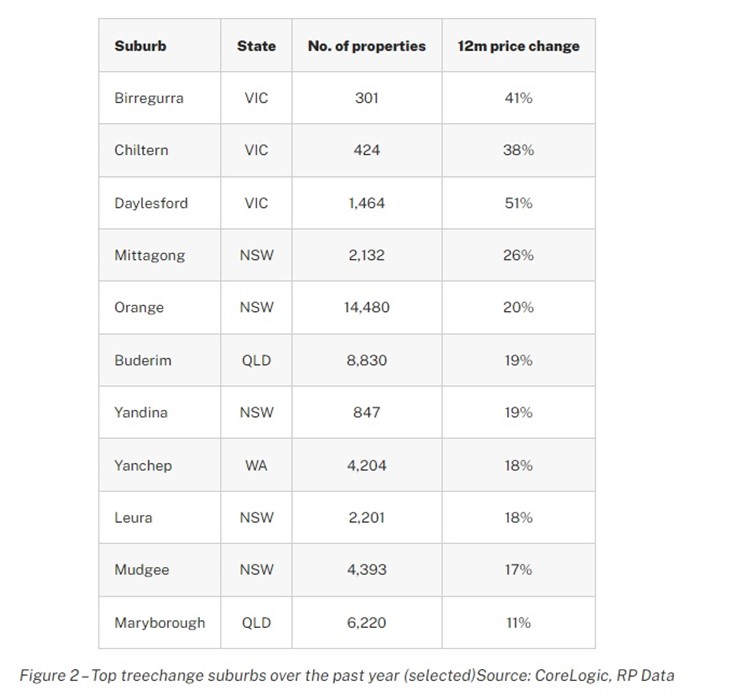

That’s not to say that treechange locations performed poorly – far from it, in many cases. Some inland markets have also benefited directly from regional moves away from the capital cities.

Mittagong and Orange in New South Wales are two examples of markets where rentals have been very tight away from Sydney, and the surge in demand has pushed properties prices higher, while asking rents have exploded.

Locations offering an attractive lifestyle from those opting to work from home more often, such as Buderim on the Sunshine Coast, have also fared well.

Overall, the results showed that regional properties had generally performed very well through the pandemic period.

But the coastal markets recorded double the rate of capital growth of the inland regions, on average, suggesting that the water continues to be greatly in favour with Australian property buyers.

How close is too close?

Is it worth the risk of buying close to the water? Yes, provided you take some precautions.

What can buyers do to protect themselves from the dangers of potential flooding?

Firstly, research. History can be a useful guide when it comes to risks such as flooding.

Furthermore, local knowledge and common sense are also important. Buying sight unseen can be risky if it doesn’t allow you to get a feel for the contours and the lie of the local land.

Ideally you should use a buyers' agent expert who is familiar with the nuances of the area you are buying in, or at least get some informed advice.

The wrap

Overall, proximity to water and water views continue to be strong drawcards for buyers of Australian property, and they can be an X-factor or point of scarcity which can drive long-term demand and capital growth.

However, there are some risks to be managed, including flooding, or the risk of a view being built out of blocked by trees, for example.

Australians have had more of a taste of working from home over the past year or two, and many are now able to continue to work remotely.

Often we are seeing that it’s these buyers who are now seeking lifestyle properties and avoiding higher density locations.

The past two years have helped strengthen ‘work from home’ opportunities meaning owner-occupiers can take advantage of ‘lifestyle’ prospects instead of being so closely tied to employment hubs.

Even well before the pandemic, there was certainly a trend of homebuyers looking for the best of all worlds – lifestyle, accessibility to employment hubs and more affordable housing.

These include areas of southeast Queensland such as the Sunshine Coast and the Gold Coast, and on the northern New South Wales Coast. Then there’s also lifestyle locations such as the Mornington Peninsula.

Beachside suburbs have especially outperformed the market as they offered such fantastic lifestyle opportunities.

To have one of the friendly Propertybuyer Buyers' Agents to contact

you in regards to buying property :

call on 1300 655 615 today.

.svg)

.svg)

.svg)