Are Units Outperforming The Market - May 2023

May 15, 2023 / Written by Rich Harvey

By Rich Harvey, CEO & Founder, propertybuyer.com.au

I’ve been watching with interest a market phenomenon we rarely see in Australia – units in some markets outperforming houses in the capital growth race.

Units are traditionally held up as a cashflow play by investors, where the prospect of a value uptick is considered long-term. In the past, some unit buyers even found their assets going backwards in value.

But that’s changed over the past year or so for a variety of reasons.

The numbers show unit price gains aren’t just keeping up with houses but exceeding them in quite a few centres.

Here’s what’s happening and how you can take advantage as an investor or homebuyer.

The data

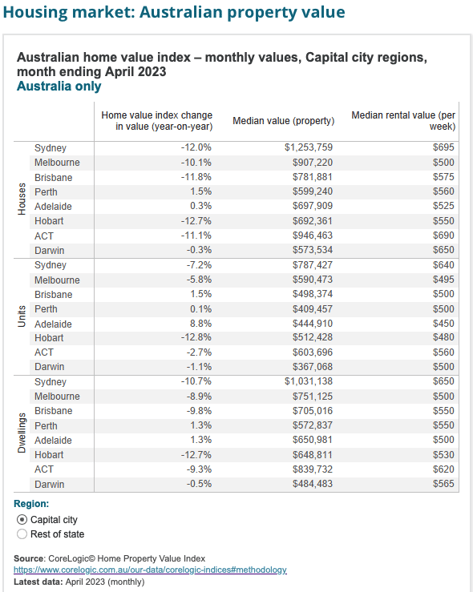

The Australian Institute of Health and Welfare published an interesting set of numbers (sourced from CoreLogic) that clearly demonstrate what’s happened across our capital city markets.

Source: Australian Institute of Health and Welfare https://www.housingdata.gov.au/visualisation/housing-market/australian-property-value

As you can see, while markets have moved in a variety of ways across various population centres, there’s evidence annual capital growth in units has exceeded that of houses in Sydney, Melbourne, Brisbane, Adelaide and ACT. This would come as a shock to many experienced investors who are used to seeing the contrary.

So, what’s driving this surge in unit appeal?

First up is affordability. First-time and low-budget buyers have been priced out of detached housing in numerous capital city suburbs. As a result, many buyers have given up on purchasing a home and instead turned to apartments or townhouses. This provides a more affordable entry into a desirable location where they can enjoy fabulous lifestyle amenities and conveniences without having to go into extraordinary debt.

Another reason is the rental crisis. Plummeting vacancy rates and soaring rents are hitting most major centres. We’ve seen a wave of tenants decide to exit the rental market and look to buy instead. The vast majority will select affordable units in convenient locations for this transition.

Then there’re those who ran to the regions during COVID. Many still work remotely and enjoy a relaxed, non-metropolitan lifestyle, but in the post-pandemic world they need to work a few days in the city each week. The need for a crash pad is integral to their plans, and units are the solution.

Then there are strategic buyers, particularly among first-time homeowners, who are thinking about long-term investment plans. Not only is this cohort looking for affordable entry into the market, but they also want to convert their first property into a rental when it comes time to move on. Units are seen as an excellent launchpad for this investment approach.

Buying well

So, units are keenly sought after in today’s markets, but will the attraction continue?

I think it will. Rising immigrations and resilient house prices suggest many of the drivers behind unit value growth aren’t easing anytime soon. So long as housing supply remains tight, well-located units with the right fundamentals will find a keen pool of buyers.

Here are some of the key characteristics that influence a unit’s capital growth potential.

Firstly, look for the right type of unit. You want something spacious with good separation between living areas and sleeping spaces. A balcony is a definite plus and if it has views, all the better. Car accommodation will also deliver a premium.

Fitout and build quality are important, but buying something that needs cosmetic upgrades is a smart move too. It’s incredibly how new floor coverings, a coat of paint and a basic upgrade to a kitchen and bathroom can add a load of pizazz (and value) to an older unit… and often for much less cost than you might imagine.

For these reasons, a well located, good size, second-hand unit can be an excellent choice.

In the same vein, avoid generic, small, investor-designed units in high rises. These spaces are plentiful, and all look the same. You want a unit that will appeal to both homeowners and investors to widen your eventual buyer base too. Investor-only designed stock just doesn’t generate enough competition between buyers.

Also, do plenty of due diligence on the complex, its body corporate and the building management team. Excessive body corporate fees or poor management can have a devastating effect on value growth.

Finally, be wary of off-the-plan. They can be a minefield for buyers. If you do decide to go down this route, never purchase without professional assistance. This includes legal advice, valuation help and a buyers’ agent.

While housing will remain a stalwart of capital growth in detached housing markets over the long term, don’t ignore the opportunity in attached housing as well. It could be the answer to your real estate needs.

To have one of our friendly Buyers' Advocate's contact you, click here to:

call us on 1300 655 615 today.

.svg)

.svg)

.svg)