How High Can House Prices Go? February Market Update

February 2, 2021 / Written by Rich Harvey

By Rich Harvey, CEO & Founder, propertybuyer

Written by: Rich Harvey, CEO & Founder

propertybuyer.com.au

Click here to watch Rich's Video of the February Market Update:

On the ground we are seeing around 40 to 50 groups at open inspections for houses. We are also seeing large numbers of between 20 to 40 groups inspecting apartments in higher quality suburbs. The rising optimism is not shared equally across every single suburb - so it is important to do very localised research and understand the market drivers that impact local prices.

The resilience of Australian property prices has been proven once again as the property market has opened its doors for the New Year. Rebounding quickly from the shackles of a Covid-19 induced recession over two quick quarters in mid-2020, we are now seeing the property market surge and prices set to rise from pent up demand.

The large volume of government stimulus money that has been injected through quantitative easing in the Australian economy has provided a strong cushioning effect to help get through the difficulties created by the Covid recession. This has helped shore up household balance sheets and helped businesses navigate the choppy waters of 2020. We're not seeing any evidence of mortgage delinquencies yet and in fact the banks have reported that mortgage repayments are better than expected for most customers.

Cheap money with historically low interest rates, likely to last for the next three years, has set the foundation for genuine property price increases. In fact, the Reserve Bank recently released a research paper indicating that property prices could rise in the order of 30% over the next three years. This is a clear indicator that buyers should take note and get into the property market earlier, rather than sitting on the sidelines waiting for a drop to occur.

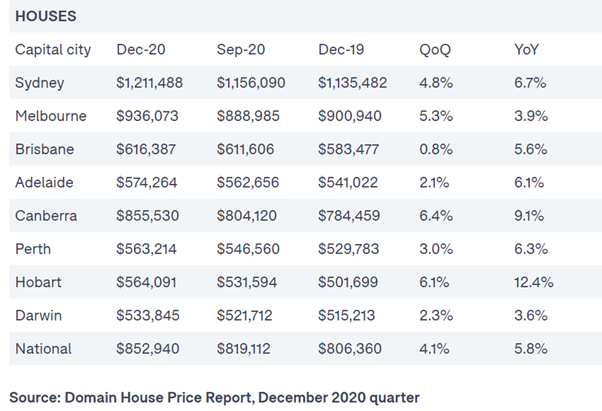

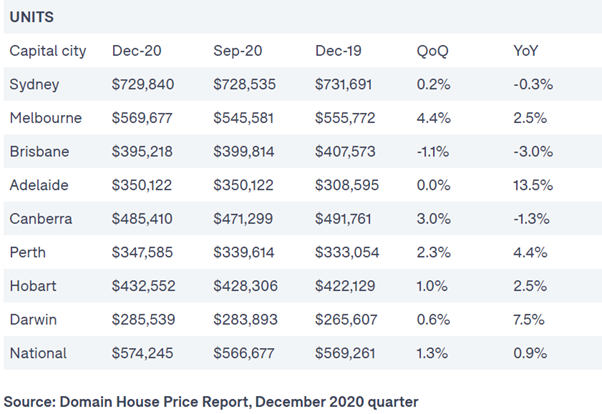

The median house price in Sydney has now reached a peak of $1.21m, while Melbourne is currently at $936,000 and Brisbane at $616,000. The latest data from the Domain House Price report released last week shows that property prices rose rapidly in the final quarter of 2020. See the latest median prices for each capital city below.

Almost all property experts expect the property market to grow significantly this year. Consumer sentiment is rising rapidly as we have come through a series of lock downs with greater optimism and unemployment did not reach double digit figures as first thought. Despite the rollback of job keeper and mortgage holiday repayments, it seems the economy is powering ahead at a faster than expected rate.

I expect to see the Government announce another round of stimulus (quantitative easing) to support the economy through the next phase of recovery. Wages growth has been sluggish and the continual state border closures has been very problematic for business recovery. It looks like our international borders will remain closed for the majority of 2021, so this means more holidays at home and the tap turned off to international migration. However, the lack of migrants has been easily replaced by over 400,000 expats coming home to roost. I expect many of these expats will remain permanently in Australia and they will inject additional housing demand.

The propertybuyer team is starting with a positive outlook for the year ahead too. We have already transacted several properties for our clients. If you are considering moving home, getting your next investment property or buying a commercial property, then please reach out for a conversation with my team to get your plans on track. No one ever got anything done by just making a wish. Put a time in your diary to plan ahead and make the call.

Please get in touch with our friendly team of buyers' agents as we would love to have a conversation about your next move. Send us your wishlist or call us on 1300 655 615.

.svg)

.svg)

.svg)