How to Leverage Your Property Equity Safely - September 2020

September 11, 2020 / Written by Rich Harvey

By Guest Blogger, Pete Wargent,

Next Level Wealth - www.gonextlevelwealth.com.au

In the first quarter of 2020, the total value of Australia’s residential property increased to $7¼ trillion.

Unlike in many other countries, most of Australia’s residential dwelling stock is owned by individuals, with public housing only comprising a small share of the total.

In fact, close to $7 trillion of the dwelling stock by value is owned by households, with only a comparatively small share being owned by non-households.

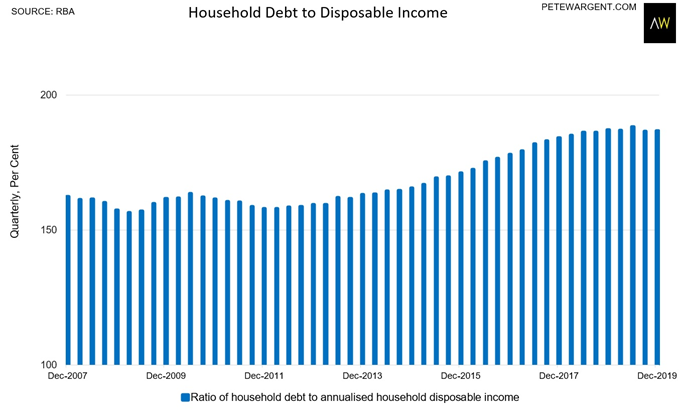

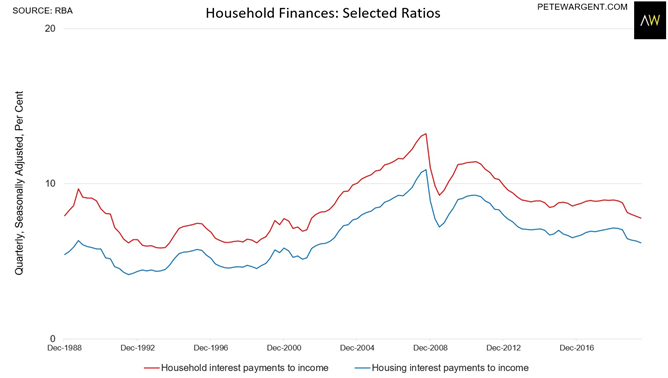

It’s often said Australia has a high level of household debt, and this is true in international terms.

However, there are 3 key points to note about this.

Firstly, Australia has a unique affinity with the use of mortgage offset and redraw facilities, and if you net off mortgage prepayments our debt-to-income ratios aren’t much changed over the past 15 years.

Secondly, mortgage rates have plunged to the lowest level on record this year, to the extent that serviceability for most incumbent homeowners has become easy.

Indeed, for all the hype interest serviceability is back to where it was in the 1980s.

And thirdly, the natural level of household debt is almost certain to be higher where landlords own the bulk of the rental stock, as compared to countries where there is a greater share of public housing.

Record Household Wealth

Although household debt has reached around $2 trillion and total household liabilities somewhat higher again, household wealth has ballooned in Australia over the past decade to hit a staggering $11 trillion.

This is a remarkable pool of wealth that makes Aussie households the wealthiest in the world.

Think about that: we have household wealth per capita of $428,000 for the 25½ million residents that make up the population of Australia.

It also means that Australia’s mortgage debt to residential land and dwellings ratio is less than 28% (while the household debt to assets ratio is under 20%).

Equity Mate

It’s clear then, that many investors and homeowners have lazy equity, and are not maximising the use of their accumulated wealth.

But how do you access your property equity what is the best way to use your equity?

Of course, it all comes down to personal circumstances, and the most important thing to consider is whether you can use leverage safely, which means not borrowing so much that you get yourself into trouble down the track.

Licensed professionals such as financial advisors and mortgage brokers can be a good place to start in terms of whether you should consider accessing your home equity, and how best to go about refinancing equity from your home or property assets.

Typically, lenders have been happy to lend up to 80% of the value of your property assets, meaning that you retain 20% equity as a buffer.

There are two main things to consider when using leverage.

Firstly, can you comfortably service the debt?

How secure will your employment be, what proportion of the costs will the rental income cover, and do you have a reasonable buffer in case of unforeseen costs or circumstances?

And secondly, you need to consider how best to use the leverage so that you achieve solid results over the longer term, which is discussed further below.

Of course, there’s nothing wrong with opting to pay down your home mortgage over time, as the interest on your home does not attract a tax deduction (unlike the interest on an investment loan).

But this ‘safety first’ approach tends to be a slower way to your building your wealth.

What To Invest In

What kind of property investments should you leverage into?

There are many ways to go, but statistically speaking more people lose money on resale when they choose to invest in new property.

Why is this so?

Partly because so many new builds, especially high-density apartments, are targeted specifically at investors, and as such suffer from a lack of consistent demand, and almost by definition they lack scarcity.

And it’s also because you tend to pay a premium to buy new property – effectively representing the developer’s profit margin – but when you come to sell the property is no longer shiny and new, and may have depreciated somewhat, having lost its newness premium.

Very often the safest and most consistent results have been seen from investing in established properties in well-established, landlocked suburbs, where the demand for housing is high and growing and the supply of new builds is more constrained.

The End Game

More retirees are taking debt into retirement these days given the low level of interest rates, but generally most of us would like to have a lower level of leverage as we move into our later years.

Your portfolio’s loan-to-value (LVR) ratio should naturally decline as you move into your 50s and 60s as you gradually retire the debt and as the value of your property portfolio appreciates.

Alternatively, you can look to sell down your portfolio as you move into the retirement phase to invest your equity in other income-producing assets.

One of the best ways to get your lazy equity working for you is to engage the services of a professional buyers’ agent who can create a smart property investment strategy and get your retirement goals on track.

To have one of the friendly Propertybuyer Buyers' Agents to

contact you in regards to buying property :

call us on 1300 655 615 today.

.svg)

.svg)

.svg)