Is Now a Good Time to Buy? - August Market Update

August 3, 2022 / Written by Rich Harvey

By Rich Harvey, CEO & Founder, propertybuyer

Written by: Rich Harvey, CEO & Founder

propertybuyer.com.au

Click here to watch Rich's Video of the August Market Update:

With media headlines dominated by cost-of-living pressures, interest rate rises and threat of economic storms ahead, it can leave property buyers wondering if it's time to sit on the sidelines - or whether it's an ideal opportunity to nab a bargain. I am constantly asked if now is a good time to buy? Let's dive into that question and uncover the current market situation and facts.

Interest rates will rise in short term the fall again.

In May the RBA increased interest rates by 0.25%. This was quickly followed by two larger interest rate rises of 0.5% in June and July. And this has been backed up by a further 0.5% increase in August which now takes the cash rate to 1.85%. This increase in interest rates has an immediate and deleterious effect on borrowers.

Tim Lawless, Executive Research Director from CoreLogic, has said that “with household debt at record highs, and most of that debt held in housing assets, the household sector is highly sensitive to the rising cost of debt. However, sizeable repayment buffers, which the RBA recently estimated to be around 21 months for variable mortgage rate borrowers, should also help to cushion distress across the mortgage sector.”

Some bank economists have recently revised their estimates of where the terminal cash rate will end up in 2023 from 2.5% to over 3% due to higher-than-expected inflation figures topping over 7%. With a more flexible and adaptable economy, we may find supply chains issues resolving sooner and absorbing the inflationary pressures. However, CBA, ANZ and Westpac economists are now tipping that we will see interest rate cuts sometime in late 2023 or early 2024 to stimulate the economy again after the sudden slow down in economic growth.

My outlook is for a terminal cash rate of 2.5% to be set and then the RBA will hold steady. With household debt much more sensitive to interest rate rises the adjustments need only be marginal to have a more widespread impact on consumer behaviour.

Borrowing capacity is key.

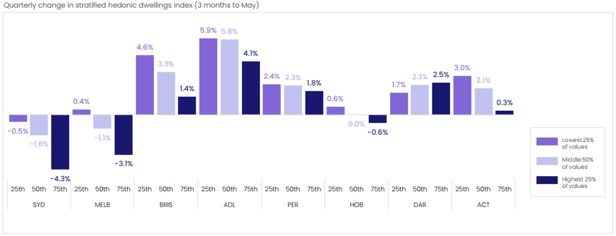

Rising interest rates has seen an immediate effect in the Sydney and Melbourne property markets with values declining -4.3% in Sydney and -3.1% in Melbourne according to the CoreLogic daily home value index (see below). The problem with these headline figures is that they are backward looking and not reflective of price movements in individual property markets. Our Buyers Advocates have been able to negotiate 7% to 15% discounts on recent purchases for our clients.

The dilemma for current home buyers and property investors is that rising interest rates significantly crimp their borrowing capacity. A 1% increase in interest rates can mean a 10% decline in your borrowing capacity - and this translates into an immediate dampening effect across the property market. Banks are still keen to lend, and more investors are coming back into the market as rental yields are rising rapidly.

If you wait too long to get your finance approved you might find your borrowing capacity is actually too low and restricted to get into the market. You are generally better off to take advantage of the borrowing capacity you can obtain at the time and trust that you can build in comfortable serviceability around interest rate rises (and the banks always assess your capacity with extra buffers in place).

Quarterly change in stratified hedonic dwelling values (3 months to May)

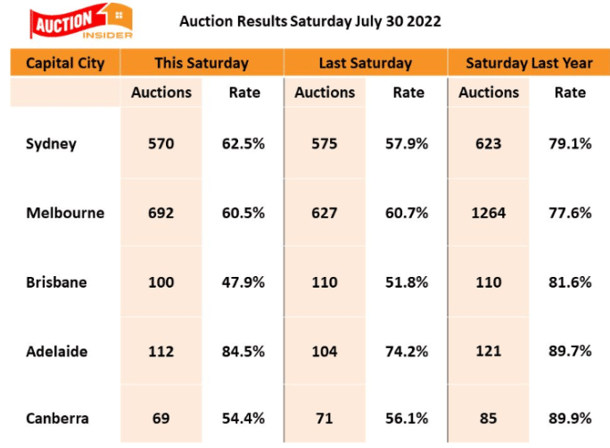

Sales and auctions sluggish

The latest auction clearance rates have shown very lacklustre results in recent months as buyers are shying away from competitive auction situations. Our team of buyers’ advocates are seeing only a handful of qualified buyers at auctions and in many cases, we are able to negotiate a great deal prior to auction day to provide the vendor with more certainty on the outcome.

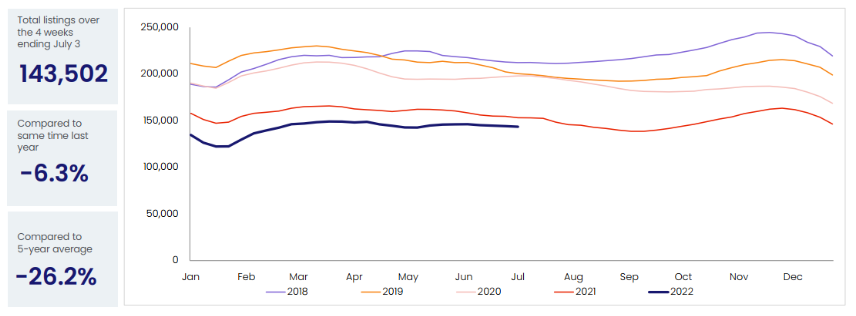

Property listings are 26% below their long-term average – see chart below. Vendors will find it harder to achieve price expectations in the coming spring market when many more properties are listed.

Louis Christopher, Managing Director of SQM Research recently said that he believes the spring market will be the weakest point in the market, and that vendors are better off selling now than waiting till next year. For buyers, this could be welcome news – more stock to choose from, and far lower prices than during the Covid boom.

Number of Total Listings, National dwellings

Buying when others are on the sidelines

Psychologically it is hard to buy property when it seems unpopular. The media is shouting “watch out”, friends are saying “be careful – don’t over-commit” and work colleagues are worried about mortgage rates rising.

While it may feel strange and counter-intuitive to buy in a correcting market, there are many valid reasons why this the BEST time to buy….and history has told this story over and over again.

- There is less competition – last year I was bidding against 10 or more bidders at auction, today I am seeing less than 2 or 3 bidders.

- You have more time to research and select the right property and compete due diligence checks.

- Consumer sentiment is extremely low – this is the ideal time to take advantage during negotiations and lock in a lower price.

- Prices will stabilise and find a floor – waiting too long to pick the exact point of the market trough is extremely difficult. As I mentioned before - the data is backward looking. Our buyers’ advocates are in the market every day, watching buyer sentiment and velocity of sales and other signals that can pinpoint the ideal opportunities.

- Once migration really ramps up, this will worsen the rental crisis. Great for landlords to increase rent, but tougher for tenants trying to contain cost of housing.

- No risk of oversupply – with construction costs rising so rapidly, the volume of building approvals has trended down substantially. This will mean we are now entering the next cycle of constant undersupply in the property market which will support prices.

Quality property is still selling for reasonably good prices. These high-quality properties will tend to hold their value far better than B and C grade properties located in inferior positions and inferior suburbs.

Summary: The message is clear…the next three months will provide some of the best buying opportunities we have seen for many years while sentiment remains low. I recommend buying now with a long-term perspective.

If you are considering your next move in property and not sure where to start, please reach out for an initial strategy chat with my friendly team of buyers’ advocates. We’d love to help you make a smart decision.

Click here to get in touch with the Propertybuyer team:

or call 1300 655 615

.svg)

.svg)

.svg)