June 2015 - Bubble or Boom, Which Way Forward?

June 10, 2015 / Written by Thirst Creative

By Rich Harvey, Managing Director propertybuyer

With ongoing speculation about the rapid rise of property prices and talk of a bubble again, it’s important to look back and compare this current Sydney boom to the “National” boom we had in 2003. The figures may surprise you. I’m also sleeping on the street for one night to raise money for homelessness,and our next seminar is coming up on June 17th.

In this edition we look at:

- Bubble or Boom - Which Way Forward?

- Seminar: Smart Tax and Investment Strategies for Savvy Property Investors, Wednesday 17th June 2015

- Vinnies CEO Sleepout

1. Bubble or Boom - Which Way Forward?

The onset of winter traditionally signals a slowdown in the property market, but this winter the direction of property prices is heading in the opposite direction to the mercury.

During May the auction clearance rate was 84% which was a record for Sydney. Some weekends the auction clearance rate was nudging 90%. The numbers attending open inspections is still very strong and number of bidders at auction also very high.

I’ve always advocated that winter is a great time to buy, as the cooler weather keeps some buyers at bay (reducing competition), but this winter expect to see continued competition in the market as there is still very healthy buyer demand. I estimate that listing volumes are down about 10% to 20% compared to a year ago. Some vendors are holding back from listing their property for sale, as they are concerned about buying back into the same market.

There’s also been some conjecture about a property bubble this week by the Treasury secretary John Fraser. However, the Treasurer Joe Hockey has also commented that it is highly unlikely we are in a bubble as supply would need to dramatically increase to an over-supply level.

Demand is being driven by very low interest rates, strong consumer confidence, low Australian dollar, strong overseas demand (especially Chinese buyers) and strong investor and up grader demand. One of the over-riding drivers of price growth in Sydney in this last cycle has been the under-supply situation. While there has been significant catch up in supply there is still a long way to go. ANZ Senior Economist David Cannington said that the annualised completion rate of dwellings rose to over 215,000, which is a new record. One four approvals is now an apartment and New South Wales was again the leader in approvals growth, up 4.4% on the month in trend terms. However the slow approval process and lack of greenfield sites will continue to restrict new supply in Sydney.

Is anything going to slow the market? The APRA restrictions on lending to investors will have a small moderating effect on investor demand and help curb speculative behaviour and natural affordability constraints will eventually slow the market (ie wages keep pace with inflation and house prices), but in the meantime the latest interest rate cut has yet to work its way through the economy.

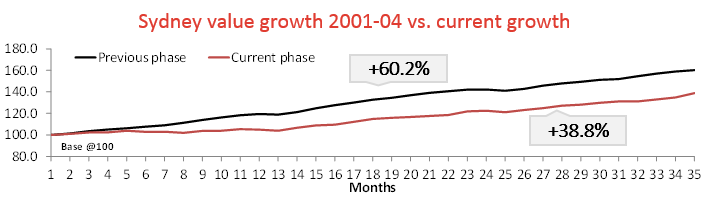

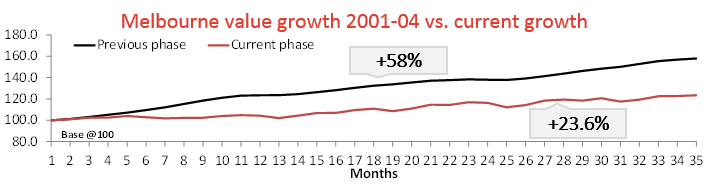

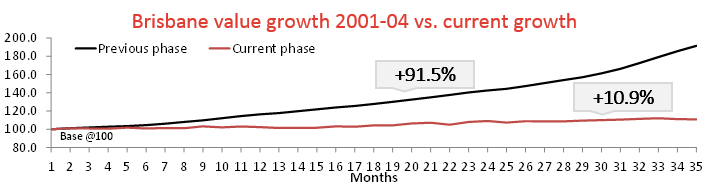

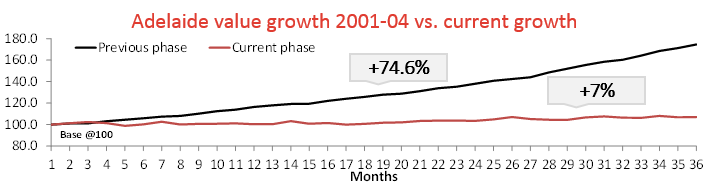

So let’s rewind the clock to the last national property “boom”. Although Sydney and Melbourne home values are recording strong levels of capital growth currently, the rate of growth is much slower than that recorded between the ‘boom’ period of 2001 and 2004.

When considering the current surge in Sydney and Melbourne home values, it is worthwhile revisiting how strong conditions were during the housing boom of 2001 through to 2004. Although the rate of capital growth in Sydney and to a lesser degree Melbourne is strong it is nowhere near as strong as the rapid home value growth recorded between 2001 and 2004.

At the beginning of 2001 the rate of growth in home values began to accelerate. The pick-up in value growth began in Sydney and Melbourne and then flowed through to the other capital cities. A major difference between the post-2000 growth phase and the current growth phase is that the post-2000 phase was not preceded by falls in home values. Another major difference is of course that the growth post-2000 was broad-based whereas the current growth in home values has been narrow, largely focused on Sydney and Melbourne. Finally household debt levels were substantially lower in 2001 than they are now, which is likely another major contributor to the stronger increase in home values then compared to now. The previous growth phase is widely accepted to have commenced at the end of 2000 however, the commencement of the current rises in values has varied across each city.

Sydney – home values began rising from May-12 and have increased by 38.8%, over the same period post-2000 they had risen by 60.2%.

Melbourne – home values began rising from May-12 and have increased by 23.6% compared to 58.0% over the same period post-2000.

Brisbane – home values reached a low point in May-12 and have since increased by 10.9%, in comparison home values had increased by 91 .5% over the same time frame post-2000.

Adelaide – home values reached a recent low point in Mar-12 and have since increased 7.0%, in the post-2000 growth phase values had increased by 74.6% over the same time frame.

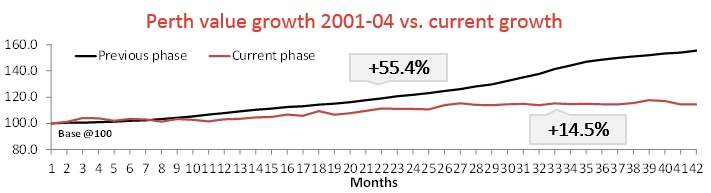

Perth – home values started rising from Oct-11 and have risen by 14.5% to Apr-14, over the same time frame post-2000 home values had increased by 55.4%.

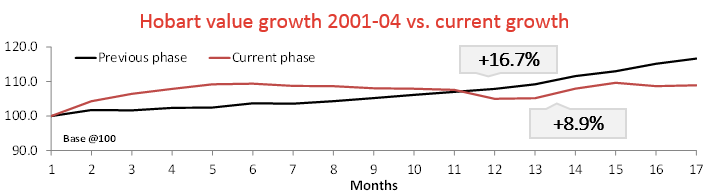

Hobart – home values reached a low point in Nov-13 and have increased by 8.9% compared to a 16.7% increase over the same time frame after 2000.

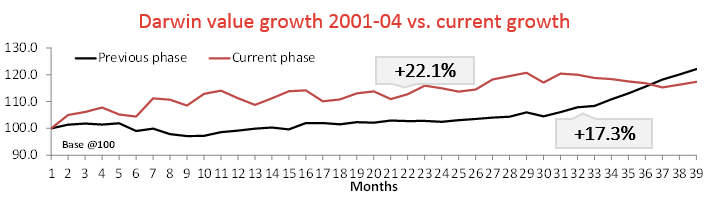

Darwin – home values hit a low point in Jan-12 and have since risen by 17.3%, over the same time frame post-2000 home values in the city rose 22.1%.

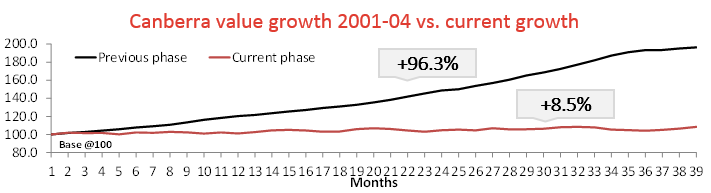

Canberra – Home values have been rising since the end of Jan-12 and have increased by 8.5% compared to 96.3% over the same time frame post-2000.

The data shows that Sydney and Melbourne are the stand-out cities for capital growth currently. More importantly, the rate of capital growth over recent years across each capital city is significantly lower than over the same time frame from 2001 onwards. In fact, Hobart and Darwin are the only capital cities in which the post-2000 level of capital growth is even close to the current level of capital growth.

Graph Source: Financial Review

Call or friendly team today on +61 2 9975 3311 or email your wishlist to discuss your requirements to give you the edge in this competitive market and put you at the front of the property buying queue.

Rich Harvey is founder and Managing Director of www.propertybuyer.com.au, Australia's most awarded Buyers' Advocates. Propertybuyer helps property investors and home buyers search and negotiate the right property at the right price, everytime. Visit www.propertybuyer.com.au or call 1300 655 615.

2. Seminar: Smart Tax & Investment Strategies for Savvy Property Investors - June 17th

Sarah, you are warmly invited to next seminar looking at ways to improve your wealth position in the coming financial year.

Around this time of year it’s timely to take stock of your current financial and tax position and look at ways to improve your financial fitness in 2016.

In this seminar we will be discussing specific strategies that you can use as a savvy investor to create the ultimate tax effective structure for your personal situation.

With three experienced speakers covering the property, finance and tax in one evening - you will walk away with the essential tools and know-how that successful property investors use.

Click here to book now here: http://stks.be/savvy-property-investors

Topics covered at this special event include:

- Which way for property markets?

- How long will this growth period last?

- Learn how to invest with just $300k

- Picking a property strategy that’s right for me

- What’s in a name – investing in your own name, a Trust, or SMSF

- Asset Protection & Estate Planning considerations

- Investment & Structural Strategies for different stages of the Life Cycle

- Property Prices: Debunking the Affordability Myth

- Tips for borrowers in current market

- Fixed vs Variable

- Be a forward looking investor

Date: Wednesday 17 June 2015

Time: 6.30pm registration, 7.00pm start to 9.00pm

Venue: Wesley Centre, 220 Pitt St, Sydney (Lyceum Room)

Cost: $19 single ticket, $29 double ticket

Click here to book now here: http://stks.be/savvy-property-investors

Telephone enquiries: 02 9975 3311

Limited seating is available so book early to reserve your spot today!

Speakers:

Rich Harvey, Managing Director and founder of propertybuyer

Rich is a buyers’ agent, property investor and professional economist with over 19 years experience in the property industry. He is a research expert and highly skilled in investment analysis and negotiation techniques that can deliver real savings for his clients.

Rich and his team have purchased over 1900 properties for their clients. As Australia’s leading Buyers' Agent, Rich has won 25 major awards including the prestigious National Telstra Business award in 2007 and also named the winner "Best Buyers' Agent in Australia" by the Real Estate Institute of Australia (REIA).

Ken Raiss, Managing Director of Chan & Naylor

Having been a commercial accountant for over 28 years with major international assignments Ken Raiss moved into professional accounting in 2004 when he joined Chan & Naylor as a Partner – now Managing Director, he assisted in its major expansion to becoming Australia’s Fastest Growing and Top 100 Accounting Firm (BRW 2007, 2008, 2013) specialising in financial services for property investors and business entrepreneurs.

Ken is passionate about property investing and small business. He maintains an avid interest in property, controlling a sizeable property portfolio and extremely proactive when it comes to increasing and protecting his client’s wealth. Mr. Raiss is a regular speaker and presenter on property accounting, tax, estate planning, asset protection

and SMSF and is a regular contributor of articles and subject matter to TV, magazines, newspapers and is often presenting and commenting on various radio stations

Doug Daniell, Director of Chan & Naylor Finance

Doug Daniell is a mortgage broker and licenced real estate agent with over 20 years’ experience in the property and finance sector. Over that period Doug has arranged over $1bn in home loans to fulfill home buyers’ and investors’ real estate financing requirements. Many of his clients have then benefited from his experience and knowledge to progress from saving for their first home to owning several investment properties. Doug gets great satisfaction from seeing somebody pay off their home loan and then helping them to progress from first a home buyer to becoming a sophisticated investor with multiple investment properties.

3. Vinnies CEO Sleepout

I will be sleeping rough on the street on Thursday 18th June to raise money for St Vincent de Paul’s annual CEO sleepout.

The experience will give me just a small taste of what it’s like for thousands of homeless people every night. I’ll be taking my beanie too as I’m hair follicly challenged!

As we head into winter, this is an even tougher time for those suffering homelessness. I will be joining some of Australia's top business and community leaders sleeping rough on one of the coldest nights of the year and would like your support.

Funds raised through the Vinnies CEO Sleepout will go towards helping the more than 100,000 Australian men, women and children who are experiencing homelessness to find the warmth, safety and dignity that they desperately deserve.

Vinnies supports people experiencing homelessness through a range of person centred and holistic support services including crisis accommodation, domestic violence support, access to budget counseling, life skills courses and legal advice, as well as assisting in planning for change and their return to independent living. Your kind donation enables this good work to continue and makes a real difference to people's lives.

It only takes a moment to help write a new chapter in the story of homelessness and help break the cycle.

Please visit https://www.ceosleepout.org.au/ceos/nsw-ceos/rich-harvey/ and make a donation.

I really appreciate your support.

.svg)

.svg)

.svg)