November 2016 - Boom or Bust. How high can prices go?

November 8, 2016 / Written by Thirst Creative

By Rich Harvey, Managing Director propertybuyer

Just how high can property prices rise? Is the sky the limit? This month I take a close look at the current growth drivers, the restraints and the X-factors that are spurring the market and examine how sustainable they are. The results may surprise you.

This November update includes:

1. How high can prices go?

2. Rich Harvey propertybuyer, Buyers' Agent of the Year

1. How high can prices go?

While many thought the Sydney and Melbourne markets had run out of steam and would correct late last year, the opposite has occurred. Prices have continued to grow and are being fuelled by a lack of supply and access to cheap credit.

In economics there is a theory of price elasticity for supply and demand - just how far can prices stretch before they snap? Well they don't exactly snap - it's just a measure of the responsiveness of the quantity of property demanded given rising prices.

There is a host of factors driving demand in the current market. These include:

- Strong local economies - Sydney has the strongest economy in Australia and has a low unemployment rate of just 5% (compared to 5.7% for Australian). Jobs growth has supported continued demand for owner occupied homes and rental property. Sydney makes up 22% of Australia's GDP, Melbourne 17%, Brisbane 9%, Perth 9% and Adelaide 5%.

- Major Infrastructure projects - In Sydney you only need to drive 10 minutes in any direction to see the major roadworks and other infrastructure projects. From Barangaroo in the CBD, to WestConnex, the North Sydney Metro West rail link, NorthConnex, Northern Beaches Hospital, Badgery's creek airport and more. There will be $70 billion pumped into these projects. n Melbourne there is over $22b billion being spent on the Metro Rail, Western distributor, Monash Freeway upgrade, CityLink Tulla Widening and new TAFE campuses.

- Population growth - Sydney has grown at an average rate of around 1.7% in the last 3 years and is forecast to grow a further 1.75% pa (i.e. another 90,000 people taking the total to 5.1m). Melbourne has been growing at just over 2.1% last year and forecast to grow another 2% next year (i.e. an actual increase of over 93,000 taking total to 4.6m). Brisbane has been growing at around 1.9% pa the last three years and is forecast to grow 1.7% in 2017 (i.e. another 36,000 taking the total population to 2.15m).

- Migration - The Department of Immigration is forecasting net overseas migration figures to be around 209,000 in 2017 and rising to 246,500 by June 2019. Australia's skilled migration policy is a key ingredient for a healthy growing economy.

- Cheap credit - With interest rates at historical lows, investors and home buyers alike are taking advantage of the best borrowing conditions in decades to acquire more property. It is likely that interest rates will remain on hold for the next 12 months.

- Planning controls - Much of Sydney's price growth has been catch up growth spurred on by lack of supply issues over the past decade. Planning controls and lack of Greenfield sites has curtailed supply of new dwellings. While there are significant acres in the northwest and southwest, not everyone wants a 1.5 hour commute to work each day, so demand for housing closer to job nodes and the CBD will continue to outstrip supply.

- Increased equity and inter-generational wealth - The boom over the last 4 years has seen home buyer's equity rise substantially. Increased equity means that downsizers are able to pay more for homes than they could previously and we also seeing a trend of parents contributing equity to assist their children break into the property market.

Despite the positive factors above, there are also several restraints that will limit price growth in the short to medium term. These include:

- Wages growth - has been very low at 2.1% over the past year

- Interest rates - a slight rise in rates will spook the market and could help tap the breaks on lending growth.

- APRA and bank lending policies - APRA's requirement to limit credit growth to investors at 10% pa worked last year, but now we are seeing a resurgence in lending for owner occupiers which will be more difficult to slow.

- Property taxes - during the election campaign we saw several policies mooted to limit negative gearing. Watch this space for further discussions on how the government plays around more with taxes.

The X-factors

As all good economists know, you can never assume things stay the same. Change is constant and the trick to predicting the future is understanding the economic fundamentals AND how it interacts with human behaviour. Property is a very personal decision and we move house or invest for different reasons, but the smart investors also know how to read the tea leaves. Here's a few hints to help on your way...

- Unit over-supply potentially over-stated - Louis Christopher of SQM Research has analysed the potential oversupply in his latest Boom and Bust report and suggests that by 2017 greater Sydney will only be oversupplied by 9000 dwellings, Melbourne oversupplied by 3000 dwellings and Greater Brisbane oversupplied by 8000 dwellings. Christopher notes that "while it is understandable to be concerned about concentrated areas of oversupply, there has not been any real evidence that such oversupply creates a contagion effect beyond the immediate areas affected". In other words, while Green Square is projected to grow by 30,000 new apartments, this will not affect demand or prices houses in Bondi or Manly.

- Consumer confidence - The dark memories of the GFC still hold in many people's minds and continues to drive investors' confidence in bricks and mortar investments. The confidence index took a dip during the election campaign but is now steady again.

- Foreign buyers - Heavy taxes on foreign buyers has slowed this flow - but it will still be an important area to watch for activity.

- SMSF - Demand by SMSF for investment property will also be a telling factor. Some reduction may be felt due to new SMSF restrictions.

- The Economy - While we have a reasonably stable economy we need to become smarter about selling our knowledge and research and have less reliance on our mineral resources.

Summary

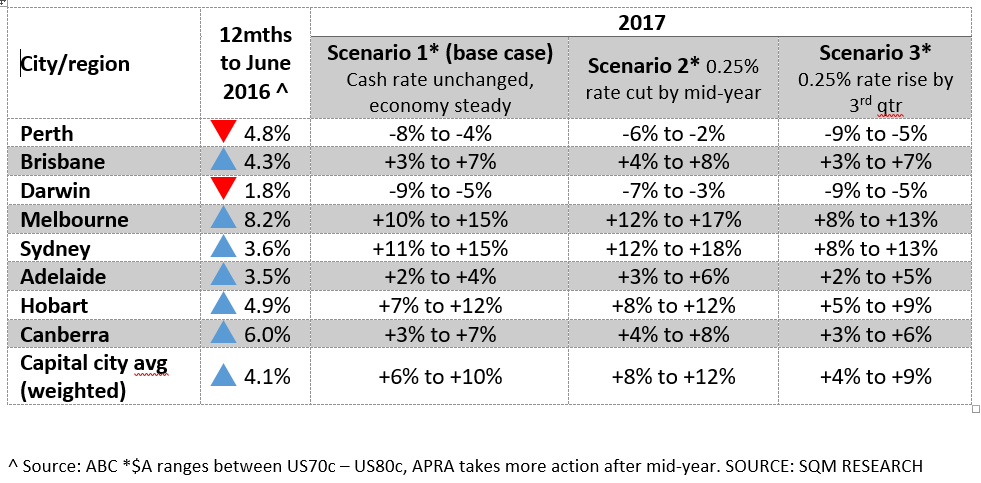

So what we can make of this? Louis Christopher of SQM Research has produced his capital city forecasts for 2017 and the results may surprise you. Sydney is yet again predicted to have the highest capital growth at double digit rates of 11% to 16%, closely followed by Melbourne at 10% to 15%. I have had to recalibrate my own price expectations in light of recent data analysis

My best tip for you is buy property near major economic generators. Property is a "derived demand" meaning that prices rise in response to demand for locations near jobs, schools, transport hubs, beaches and top amenities (rather than just the property itself).

For home buyers, it means you need to consider the attractiveness of the suburb. Who will buy after you? Does the suburb have a good future?

For investors - you need to consider who will want to rent the property in the future. Is the rental yield sustainable? Will there be an influx of units that could depress prices in the short term?

What is the feeling you want to get after you have purchased your next home or investment? You certainly don't want buyers' remorse! You want to feel happy and satisfied that you've made a wise purchase, and that your investment is safe - that the price you paid is fair and you expect to look back in 10 years and say "wow- that was cheap".

If you are looking to buy your next home or investment property and avoid buyers' remorse please call my friendly team of professional buyers agents on 1300 655 615 or complete your property wishlist today and start a conversation today.

Rich Harvey is founder and Managing Director of www.propertybuyer.com.au, Australia's most awarded Buyers' Advocates. Propertybuyer helps property investors and home buyers search and negotiate the right property at the right price, everytime. Visit www.propertybuyer.com.au or call 1300 655 615.

2. Buyers' Agent of the Year

We are vey proud to announce that we have been named Buyers' Agent of the Year for a 2nd year running by Your Investment Property Magazine, Readers' Choice Awards and also Buyers' Agent of the Year for the 8th time by the REINSW Awards for Excellence.

It is an honour and priviledge to be voted the winner of these award. We really appreciate the support of our clients and business partners. It is really a team effort!

What did our voters say?

"Rich has always given his best knowledge, integrity, service and more. He has also equipped the company with a first class team to meet different aspects of what buyers want. Trust and speciality in his industry is what Rich excels in. In today's market, that's the tyupe pof outfit we need." Catherine

"Rich as a wealth of personal and professional experience in property investment. He truly walks the talk. Rich has an economics degree and is flawless in his research approach. He is extremely personable and takes great pride and care of his clients and their needs, and is genuinely concerend and interested in his clients' financial freedom - not just now but also in the years ahead." Paul

.svg)

.svg)

.svg)