Navigating the luxury property market: tips for high-net-worth buyers - July 2023

July 21, 2023 / Written by Pete Wargent

By Guest Blogger, Pete Wargent,

Next Level Wealth

A rollercoaster ride

Expatriates, business owners, healthcare specialists, non-resident buyers, and other high-net worth individuals are among the many groups that are seeking to upgrade their home or purchase property in Australia’s most salubrious neighborhoods.

Yet finding a home in the prestige market can be like searching for a needle in a haystack, especially through this property market cycle where quality stock levels have been so chronically tight.

The prestige property market tends to be less directly impacted by higher interest rates as compared to suburbs in the more leveraged mortgage belt.

It can instead be buffeted by a strong economy where executives are being paid handsome bonuses and business transaction activity is healthy.

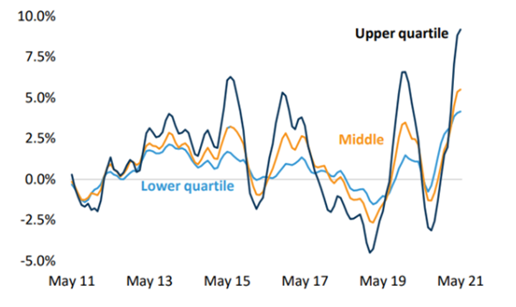

Generally speaking, the upper quartile of the housing market is a thinner and more volatile sector through the housing market cycles, particularly in Sydney.

In the good times prices can outperform significantly - and often in an irrationally exuberant fashion - but when sentiment ebbs away there are few buyers willing and able to pay those previously soaring prices and the premium sector of the market then underperforms to the downside.

Over the long run price performance can be great, but it will be more of a rollercoaster journey to the destination.

In the recent cyclical market downturn as interest rates began to rise Sydney saw the upper quartile of the market see a decline in median prices of around 18 per cent, arguably one of the largest nominal price declines the Aussie housing market has experienced.

But as the market began to fire up again we have seen some examples of huge prices being paid and suburb records once again beginning to tumble…

Snob effect: premium housing and Veblen Goods

What are the key drivers of at the top end of the property market, such as properties over $5 million to $10 million, or more?

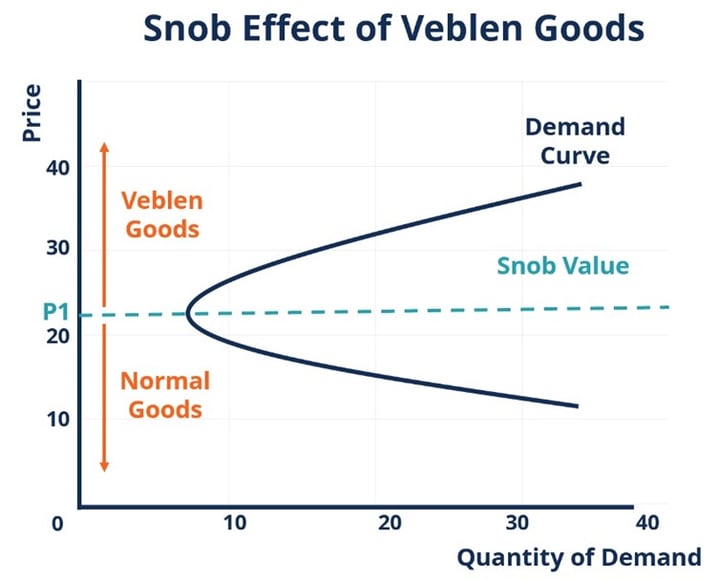

In The Theory of the Leisure Class in 1899, economist Thorstein Veblen posited that conspicuous consumption was a way of the wealthy displaying status symbols, to signify that they can afford things the average person cannot.

Veblen goods can apparently defy the normal laws of supply and demand, becoming more desirable as the price levitates away from the common consumer.

This explains why a new model of Ferrari can be sold out years in advance, despite the alarming price tag, or why a simple Banksy painting could be sold by Sotheby’s for a seemingly absurd £18.6 million.

There’s nothing new about people saying that Sydney house prices are “crazy;” it’s more or less been a permanent topic of conversation for as long as I can remember, and no doubt long before that too.

Not too long after I was born, in 1979, the Elizabeth Bay mansion Boomerang sold for $1 million, reportedly becoming the first home in Australia to achieve a 7-figure sale.

Today, though, it would likely fetch 100x that figure.

Recently a modest 1920s bungalow perched high on the cliffs of Tamarama, Lang Syne, was listed with a price guide of $47 to $52 million and was sold quick-smart to an advertising guru for around $45 million, comfortably eclipsing the previous suburb record of $29 million.

Lang Syne, recently sold for $45 million.

Wonkish housing market analysts with carefully crafted cashflow projections have often argued that property prices are too high, and must come down if anything premium prices have seemingly accelerated.

Why have they been so wrong, and for so long?

A more useful mental model in such cases would be to consider eastern suburbs homes like these as a Veblen good.

The super-wealthy buyers are not looking at discounted cashflows, rental yields, or indeed any relevant metrics of this nature.

Top-end homes in premium markets are often bought to signify wealth and status above and beyond what most people can contemplate, and with such housing consumption motivated by the Veblen effect the prices soar up, up, and away.

This is especially the case in a wealthy and rapidly growing country like Australia, which – to date at least – doesn’t have death duties or punitive inheritance taxes.

Navigating the premium market

There’s been an extremely low volume of listings in the luxury market, the reasons for which may be debated.

In the premium market assets are often retained for intergenerational wealth, while the extremely elevated level of transaction costs such as stamp duty discourage buying and selling too frequently.

At the top end of the market, such as in Sydney’s eastern suburbs for example, most high-end transactions are negotiated through buyer’s agents and off-market deals, rather than being widely advertised through the usual channels and portals.

At the premium end of the market buyers tend to look for location, scarcity, style, privacy, and security, and they are unlikely to compromise too much on these factors.

On the other hand, premium sector buyers are less interested in cashflow or annual rental yields, which are invariably low as a percentage of the property purchase price.

4 key tips for buying premium property

To conclude, here are a handful of 4 key tips for anyone thinking about buying a property in the $10 million range and above.

First, seek assistance! Premium property can be difficult to source through a cliquey network of key real estate agents, so it pays to have an insider on your side, such as an experienced and licensed buyer’s agent who is familiar with the local market.

Second, speak to your accountant before pulling the trigger on any purchase, so you don’t pick up any unpleasant tax or structure-related surprises.

Third, remember market cycles. Premium property prices may fall the most in downturns, only to boom the most in the rebound and upswing phases. Be aware of this when you prepare to buy and strategies accordingly.

And fourth, think about the location, scarcity, and timeless features which will genuinely differentiate your purchase. In Australia water views are very highly sought-after, for example (though do consider flood risk and the related impact on any future insurance premium or resale value).

Happy hunting.

To have one of the friendly Propertybuyer Buyers' Agents to contact

you in regards to buying property :

call on 1300 655 615 today.

.svg)

.svg)

.svg)