Property versus shares performance - June 2020

June 16, 2020 / Written by Rich Harvey

By Guest Blogger, Pete Wargent,

Next Level Wealth - www.gonextlevelwealth.com.au

The great debate!

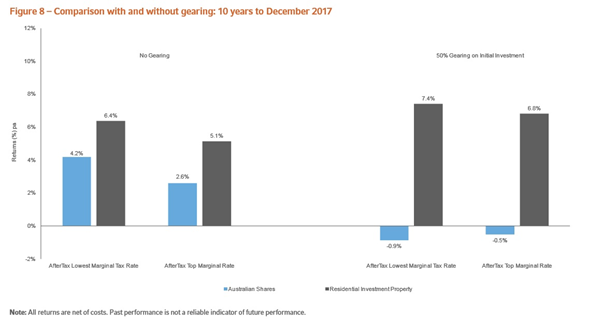

Over the 10 years to December 2017, Australian property had another golden decade, and promptly wiped the floor with Aussie shares in terms of gross returns.

50% geared returns were exceptionally strong for property, but negative for stocks.

Source: Russell Investments

If you consider the fact that a property investor might typically leverage up by 4:1 there really was no contest, at least over that time period.

In fact, gearing into stocks too often led to disastrous outcomes over this time period.

Of course, all asset classes move in cycles, and we should always be wary of cherry-picked timeframes.

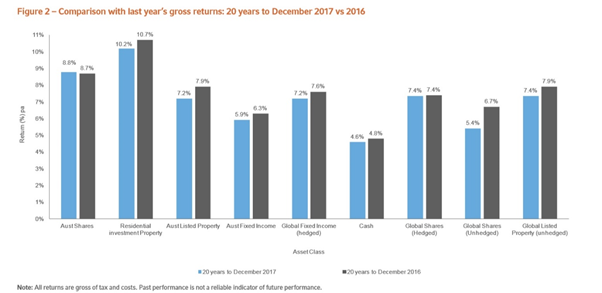

Moving the dial out to a 20-year timeframe the unleveraged returns from Australian property (10.2% per annum) versus Australian shares (8.8% per annum) were somewhat closer over the two decades to December 2017.

Source: Russell Investments

Again, though, after considering the potentially powerful use of leverage, there has been no contest, and capital city property in Australia was the ‘winner’ over that time frame.

From a personal standpoint, as an investor in both asset classes, there is simply no way I could have achieved the same results without using property and leverage over the past 20 years.

Not even close.

The tailwind

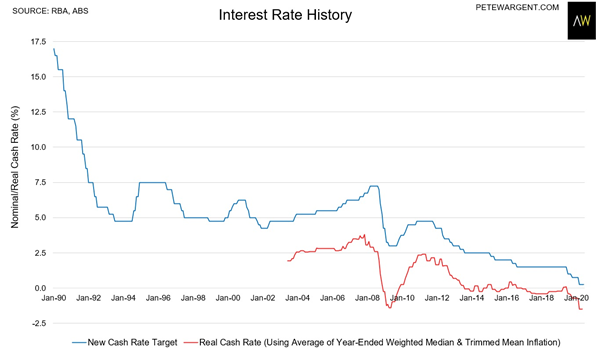

It is sometimes said that the next 30 years will not look like the past 30 years.

And in many respects, this will be true, not least for interest rates.

The official cash rate spent fully 16 years oscillating between 4.5% and 7.5% - with mortgage rates plenty higher still – but since 2008 the trend for rates has been only in a downwards trajectory.

Interestingly now the real cash rate has dipped into negative territory again, a dynamic which previously led to a strong period of returns for real estate assets.

Since 2017 things have been much quieter for property, as the asset class has endured both a regulatory credit squeeze and a Royal Commission into banking misconduct.

Aussie stocks, meanwhile, experienced a bone-shaking 35% crash in early 2020, taking the ASX 200 index back to where it was a decade-and-a-half earlier, though there has been a modest rebound at the time of writing.

Property or stocks (or both?)

It is clear for all to see that all asset classes have cycles.

Bull markets are followed by corrections or bear markets, and the cycles continue to repeat.

Even within asset classes certain cities or sectors and styles will experience their own cycles.

Generally, both property and stocks have performed strongly as growth asset classes in Australia over time, with these asset classes also being treated more preferably from a tax perspective than fixed income in Australia.

Which is the most preferred asset class for you will come down to your own situation, goals, and personal preferences.

Capital city resi property has tended to work well as a medium - or long-term investment, delivering more so in terms of capital growth than it does rental yields (which are typically modest on capital city residential assets).

In part due to dividend imputation, Aussie stocks have generally delivered a much higher yield than the MSCI Global average, while allowing investors to benefit from franking credits in many cases.

For me this suggest that property can work well to build my net worth or equity, while managing liquid assets between stocks and cash can build my income over time as well.

That has been my preferred approach, but there are many others.

The two asset classes are quite different but can be complimentary if used sensibly and at the right stages in their respective cycles and your own wealth journey.

To get the best buyers’ agent on your side helping you find the right opportunities to grow your wealth, engage the team at propertybuyer to discover more off market deals and have an accountability partner along the journey.

To have one of our friendly Buyers' Agents to contact you in regards to buying property :

call us on 1300 655 615 today.

.svg)

.svg)

.svg)