What’s Australia’s Number 1 Wealth Creator? - November 2021

November 17, 2021 / Written by Rich Harvey

By Rich Harvey, CEO & Founder, propertybuyer.com.au

A look over the BRW’s Rich List each year probably has some readers wondering why they didn’t take a different career path. Who’d have thought learning to write computer code could make you a multi-billionaire? Perhaps we should have pursued life as an investment banker, or hedge fund manager? Maybe digging around in the mining industry wouldn’t have been a bad option?

But don’t let this get you down. These tales of success represent the one-percenters who don’t embody the average battler and their path to financial security.

Besides, everyday Aussies are already enjoying the fruits of this country’s biggest wealth generator, and many don’t even know it.

Best of all, by exercising some common sense and relying on trusted advice, its quite simple to plan ahead and reach financial independence via this particular investment vehicle, and enjoy a life well in excess of what you might imagine.

And that’s because in Australia, real estate is, officially, our number one source of wealth.

Property’s stronghold

Did you know Australian residential property is responsible for 60 per cent of the county’s net wealth?

I know – it sounds unbelievable.

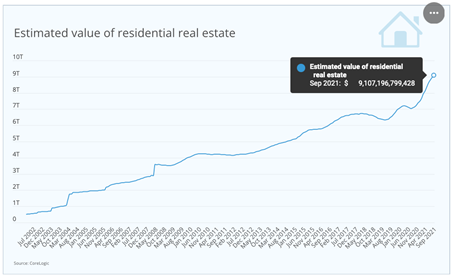

Data powerhouse CoreLogic recently announced that the total value of Australian property has reached a new benchmark.

CoreLogic Head of Research, Eliza Owen, said “The value of Australian residential real estate has surpassed $9 trillion dollars over September. This comes just five months after the market exceeded $8 trillion over April.

“This puts housing values around 28.2% higher than the estimated value of superannuation, the ASX and commercial real estate combined.”

Now these are big numbers, but here’s the great thing about our nation’s property.

Everyday Aussies are the beneficiaries. This asset is egalitarian in nature – by simply buying and owning a home, you are taking part in one of the world’s most consistent investment vehicles.

And the path to entry and participation in Australian real estate is not that difficult. By applying a few well-established fundamentals, most of us are trekking our way to financial security.

Here are just three key elements that will help you stay the course:

1. Buy well to profit later

An essential tenet of property is that you make your money on the way in, not on the way out.

While some may think this means you need to secure a great property at a bargain price, I beg to differ.

Making your money on the way in means buying the right kind of asset in the first place. It is possible to lose money by purchasing the wrong property at a ‘cheap’ price. If you buy wisely and select a home or investment with the right fundamentals, you will be rewarded over the long term, even if you do pay slightly more than you expected initially.

2. Be a ‘stayer’

The two biggest regrets I hear from stakeholders are, “Why didn’t I buy earlier?”, and “Why did I sell so soon?”

Even today, with prices running hot, the old adage – time in the market, not timing the market – has never been truer.

If you are looking to profit from your purchase, be ready to act quickly when the right property comes along. Then, if you want to grow wealth, be prepared to ride out ownership over at least a price cycle or two.

Time in the market, and the compound growth it delivers, is a magic formula for building personal prosperity.

3. Prepare to diversify

Too many amateur investors look to improve their fiscal position by buying a property in their home suburb simply because of familiarity. They reason that they understand their home suburb’s quirks and differences, so they know what to buy to get the best returns.

While I don’t doubt these owners have an intimate understanding of where they live, I can tell you hand on heart that property markets are a more complex tapestry than this approach indicates. Just in and around Sydney, for example, there are multiple locations I believe will deliver above-average price growth over the next few years.

And it’s not just the location you need to worry about. Particularly properties will do better than their neighbours because of fundamentals we expert property buyers know well. Be prepared to think beyond your home suburb and/or property types, and you will reap the rewards.

Being part of Australia’s’ growing real estate wealth isn’t difficult – but making serious gains takes time, preparation, due diligence and solid networking. That’s why it’s best to draw on the guidance of an expert buyers’ agent. We have the skills to ensure you buy right and enjoy the benefits.

To have one of our friendly Buyers' Agent's contact you, click here to:

call us on 1300 655 615 today.

.svg)

.svg)

.svg)