The ‘confidence glitch’ advantage for long-term thinkers - November 2023

November 22, 2023 / Written by Rich Harvey

By Rich Harvey, CEO & Founder, propertybuyer.com.au

When the Covid pandemic kicked off in early 2020, economists and pundits swiftly predicted a property price crash in the order of 30 per cent, when in reality, they rose by more than that.

Around this time last year, with the Reserve Bank well-and-truly on the warpath with interest rates and the economy looking rocky, experts were again warning of declines through 2023 of between 10 and 15 per cent.

But here we are, with national home values having risen across this year by more than seven per cent. In Sydney, Brisbane and Perth, they’re up by more than 10 per cent. And that doesn’t include November’s results.

It would’ve been easy to fall victim to the ‘confidence glitch’ – the wiring in our brains that overrides what we know to be true when we’re faced with uncertainty.

Do you have the confidence glitch?

If you’d listened to the shouting headlines and taken stock of the doom and gloom on those occasions – and countless other examples I could provide you – then just imagine where you’d be.

You’d be without the home or investment property that you might’ve otherwise bought, and without the capital growth that would’ve accumulated.

This isn’t a cautionary tale about missing out on making a quick buck, though. Although those who defied the warnings certainly have turned a profit. This is a story about the importance of thinking long-term.

And it’s a reminder that what’s happening right now, what’s going to happen next month, and the forecasts for next year shouldn’t really matter.

Property isn’t a short-term game

Despite property prices continuing to rise to new record levels and far too many young Australians finding it harder and harder to get into their own home, there are still people making quick gains in real estate.

It’s hard to believe when you look at the median dwelling prices in each capital city. As of the end of October, CoreLogic data shows the median home value in each capital is:

• Sydney: $1,121,196

• Melbourne: $778,541

• Brisbane: $770,575

• Adelaide: $700,024

• Perth: $631,195

• Hobart: $662,166

• Darwin: $497,315

• Canberra: $842,722

They’re the kinds of numbers that get discussed at backyard barbeques and dinner parties, where those present will inevitably scoff that prices can’t get any higher. “Surely we’re in for a crash. The heat must come out of the market sooner or later,” some might say.

And it probably will at some point, and to some extent because that’s how markets work.

If there’s a shock of some kind that shifts the supply and demand drivers, be it political or economic or social, then there could very well be a decline. There was for the last seven months of last year, on the back of rate rises, when values slipped almost everywhere.

Those losses have largely been erased, and then some, due to extraordinary demand and very limited supply, showing that the shock was relatively brief in the grand scheme of things.

Similarly, the shock of the Global Financial Crisis – a once-in-a-generation event that left the world reeling and brought major economies to a grinding halt – didn’t leave much of a lasting impact when it’s all said and done.

But there was plenty of panic, a market response, a period of instability, and then eventually some clear air.

To panic or to focus?

Let’s say you bought an investment property in the early 1990s, right before Australia experienced the “recession we had to have” and interest rates soared to an eye-watering 17 per cent.

You’d panic, right? You’d possibly be inclined to sell up and run for the hills. Or let’s say you were thinking about buying but then got spooked and sat on your hands instead.

It was a tough few years, there’s no doubt. But eventually, the economy settled down and interest rates began to drop, and supply and demand evened out a little, and national home values began to steadily lift.

Markets were well on the way up by the end of the decade, so let’s say you were about to buy an investment then… but the Asian Financial Crisis in the late 1990s and all of the economic chaos it brought scared you off.

Or maybe it was some other major event, like the September 11 terrorist attacks, an historic change in government in 2007, the GFC, major regulatory changes by the banking watchdog, political instability in the Rudd-Gillard-Rudd era, fluctuations in the commodities markets, inflation… and so on.

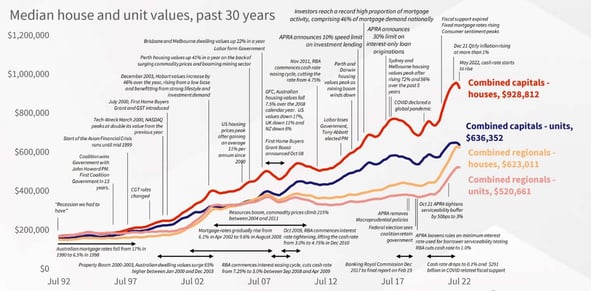

I think you get my point. If not, let this chart paint a thousand or more words for me.

Source: CoreLogic

Over that three-decade period, Australia’s housing markets have gone through six periods of growth and six periods of decline. There are undeniable cycles driven by a range of factors, but the undeniable trend is upwards.

In fact, between mid-1992 and mid-2022 when that analysis was conducted, national home prices increased by 382 per cent.

You’ve got to feel for that guy who thought the “recession we had to have” and rising interest rates were his cue to avoid real estate.

There will be plenty of economists and other experts that will provide their commentary on market direction and pricing. Even today there are conflicting headlines about price predictions rising and falling in each capital city. But taking a long-term view and buying as soon as you can afford to is a proven strategy.

Be strategic, be smart, be patient

There are a few reasons to feel uncertain at the moment, there’s no denying it. But my point is that uncertainty is ever-present, and if you’re in real estate for the long haul, then it doesn’t really matter.

If you’re strategic about your investing, if you’re informed about markets and your personal situation, and if you’re prepared to play a long-term game, then history shows time and time again that the only way is up.

Keep your eyes on where you’re heading and don’t be sidetracked by shortcuts or storm clouds.

To have one of the friendly Propertybuyer Buyers' Agents to contact you:

call us on 1300 655 615 today.

.svg)

.svg)

.svg)